Waymo Stats 2026: Funding, Growth, Coverage, Fleet Size & More

A look at the key stats and milestones from Waymo, Google’s former self-driving project and now an autonomous vehicle subsidiary under Alphabet

Waymo has been leading the autonomous vehicle revolution for almost two decades now. What started as Google’s self-driving car project in 2009 has now become one of the biggest autonomous ride-hailing services around, just less than 10 years after becoming a separate company.

Since launching its commercial service in Phoenix in 2018, Waymo is now handling over 450,000 trips per week across 6 major cities. With a fleet of self-driving Jaguar I-PACEs, and Zeekr robotaxis (Ojai), it’s one of the largest AV services on the road today.

We’ve gathered some key statistics on Waymo’s fleet, trip volume, funding, market share and city breakdowns, and we’ll keep it updated regularly. Check it out below!

This article was last updated on February 26, 2026.

Waymo Key Statistics

Waymo says it has recorded more than 20 million paid rides.

Waymo has done over 200 million autonomous miles on public roads.

Waymo vehicles also offer freeway rides in Los Angeles, Phoenix and San Francisco (link). They’ve also surpassed 1 million autonomous miles on freeways (link).

They started picking up and dropping off from their first airport (Phoenix Sky Harbor) at the end of 2022. They also began operation at San José Mineta International Airport (SJC) in November 2025, and San Francisco International Airport (SFO) in January 2026 (link). They are also conducting employee-only testing at Dallas Love Field Airport and San Antonio International Airport (link).

As of June 2025, Waymo’s staff had grown to 2,500 employees (link).

Waymo is currently valued at $126B after its most recent $16B funding round in February 2026, led by Alphabet (link, no paywall).

Waymo Overview

A few quick facts about the company1:

Key Executives

Dmitri Dolgov - Co-CEO, @dmitri_dolgov

Tekedra Mawakana - Co-CEO, @TechTekedra

Saswat Panigrahi - Chief Product Officer, @saswat101

Steve Fieler - Chief Financial Officer

Mauricio E. Peña - Chief Safety Officer

Waymo Funding

Waymo has not followed the traditional startup fundraising path with clearly delineated Series A, B, or C rounds, especially in its early years as it was an internal Google project (now under Alphabet). However, here is a breakdown of its known fundraising history since it began raising external capital:

In total, Waymo has secured $27.1 billion in funding from 2020 to 2026, with notable investors including Alphabet, Fidelity, Perry Creek Capital, and T. Rowe Price, among others2.

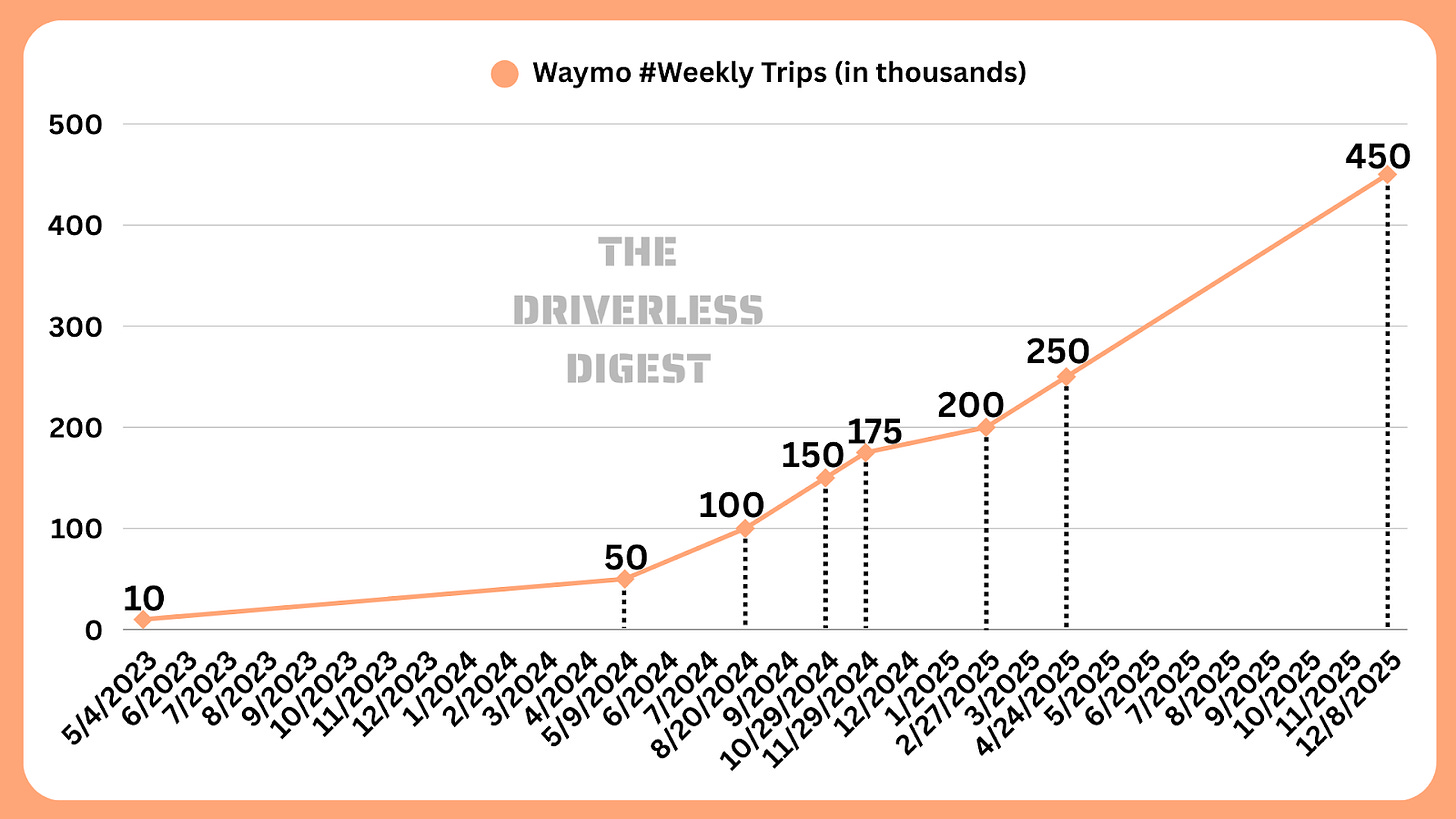

Weekly Trips (All Cities)

May 4, 2023 – Waymo hit 10,000 weekly rides.

May 9, 2024 – Reached 50,000 weekly rides (Just over a year later).

August 20, 2024 – Doubled to 100,000 weekly rides (just 3 months later).

October 29, 2024 – Reached 150,000 weekly rides.

November 29, 2024 – Hit 175,000 weekly rides (only a month later).

February 27, 2025 – Surpassed 200,000 weekly rides.

April 24, 2025 – Crossed 250,000 weekly rides across its 4 major markets.

December 8, 2025 - Crossed 450,000 weekly rides across its active cities.

Extrapolated Weekly Trips (All Cities)

Waymo hasn’t officially released updated numbers on weekly trip growth since April 2025 but we can look at historical and recent monthly growth data to extrapolate their numbers as at August 24, 2025. Waymo’s overall (May 2023 → Apr 2025) compounded growth rate is ~14.6% per month. Their most recent period of released data (Feb 27, 2025 → Apr 24, 2025) had a monthly compounded growth rate of 12.9%, so conservatively extrapolating that number (12.9%), we conclude that Waymo was doing almost 360,000 trips per week on August 24, 20253.

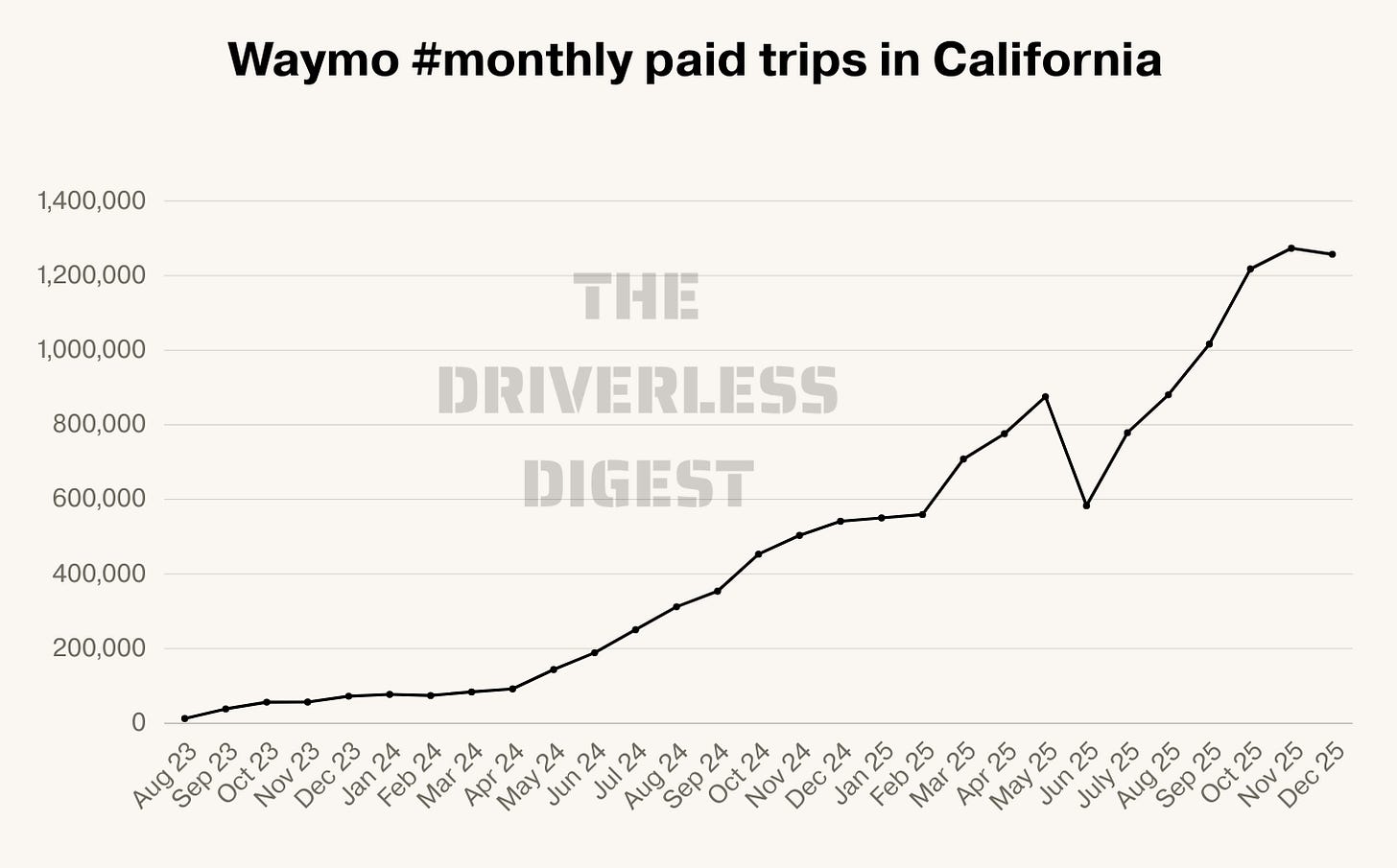

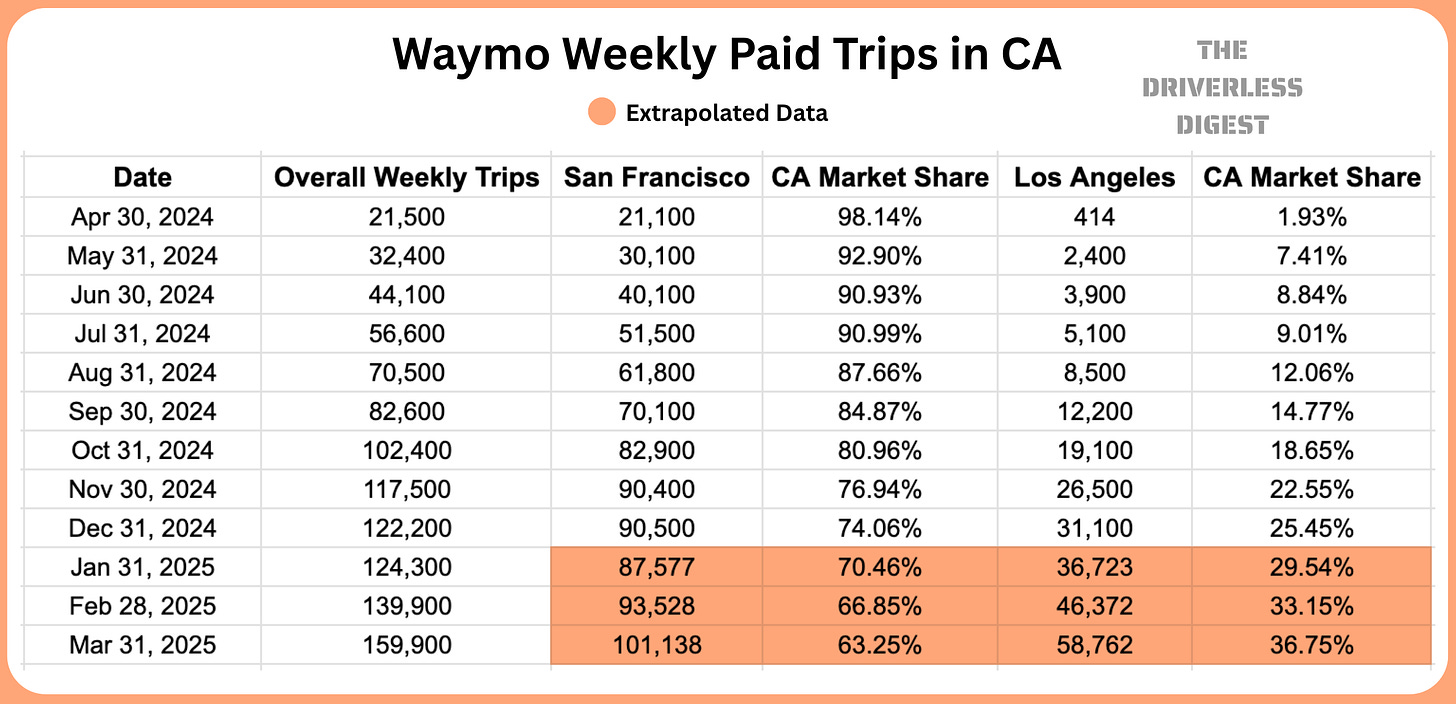

California Trip Data

The California state regulator for ridehail and robotaxis is the California Public Utilities Commission (CPUC). As part of their reporting requirements, Waymo is required to submit quarterly reports detailing various operational metrics, including monthly/weekly paid trips, cancelled trips, etc.

The latest release of CPUC data was from February, 2026 (with data through December 2025). Waymo’s growth peaked in November 2025 after taking a big drop in June 2025 when Waymo had to pause services in both Los Angeles and San Francisco due to vandalism during ICE protests.

Waymo stopped reporting market share by city at the end of 2024, but we extrapolated Los Angeles’ growth rate to come up with the current number of weekly trips in both cities as of the end of March4.

Where can I get a Waymo?

Waymo is currently offering paid driverless rides in 10 major cities:

Phoenix, Arizona: Waymo’s first public launch happened here in October 2020. Riders can book trips directly through the Waymo app, or through the Uber app by requesting an UberX, Uber Green, Uber Comfort, or Uber Comfort Electric ride and choosing a Waymo vehicle option. Getting matched to a Waymo through the Uber app is subject to availability. African fintech Moove runs its fleet operations, facilities and charging infrastructure here — and plans to do the same in Miami soon.

San Francisco Bay Area, California: They opened to the public on June 25, 2024. Rides are available exclusively through the Waymo app.

Los Angeles, California: Waymo launched in LA on November 12, 2024. Rides are available exclusively through the Waymo app.

Austin, Texas: Public rides began on March 4, 2025, but only through the Uber app. When you request an UberX, Uber Green, Uber Comfort, or Uber Comfort Electric ride, you might get the opportunity to accept a Waymo ride on the confirmation screen, depending on availability.

According to Uber’s CEO, Avomo (formerly Moove Cars) runs fleet management for Uber in Austin - not to be mistaken with Moove.io.

Atlanta, Georgia: Public rides began here on June 24, 2025. Riders can only hail a Waymo through the Uber App. And like in Austin, there are no guarantees you’ll get a robotaxi every time. Riders need to opt in to the ‘Waymo on Uber’ option and then request an UberX, Uber Comfort, or Comfort Electric — and if a Waymo is available, you’ll get the option to accept the ride. Same as in Austin, Avomo (formerly Moove Cars) runs fleet management for Uber here - not to be mistaken with Moove.io.

Also available to ‘select Waymo One riders’ in:

Miami, Florida: On January 22, 2026, Waymo began offering limited driverless rides through the Waymo One app, to a small group of riders who signed up for early access in Miami, starting with an initial 60-square-mile service area. The company plans to open the service to the general public, expand the service to Miami International Airport and add freeway rides later in the year. This rollout is in partnership with Moove, which manages fleet operations, facilities, and charging infrastructure; Moove plays the same role in Phoenix as well.

Houston, Dallas, & San Antonio, Texas; and Orlando, Florida: On February 24, 2026, Waymo announced the launch of service in these four cities, beginning with select riders, with broader access rolling out over time and full public availability expected by the end of 2026. Avis Budget Group is their fleet partner in Dallas, handling end-to-end operations — from infrastructure and vehicle readiness to maintenance and depot management (link, no paywall).

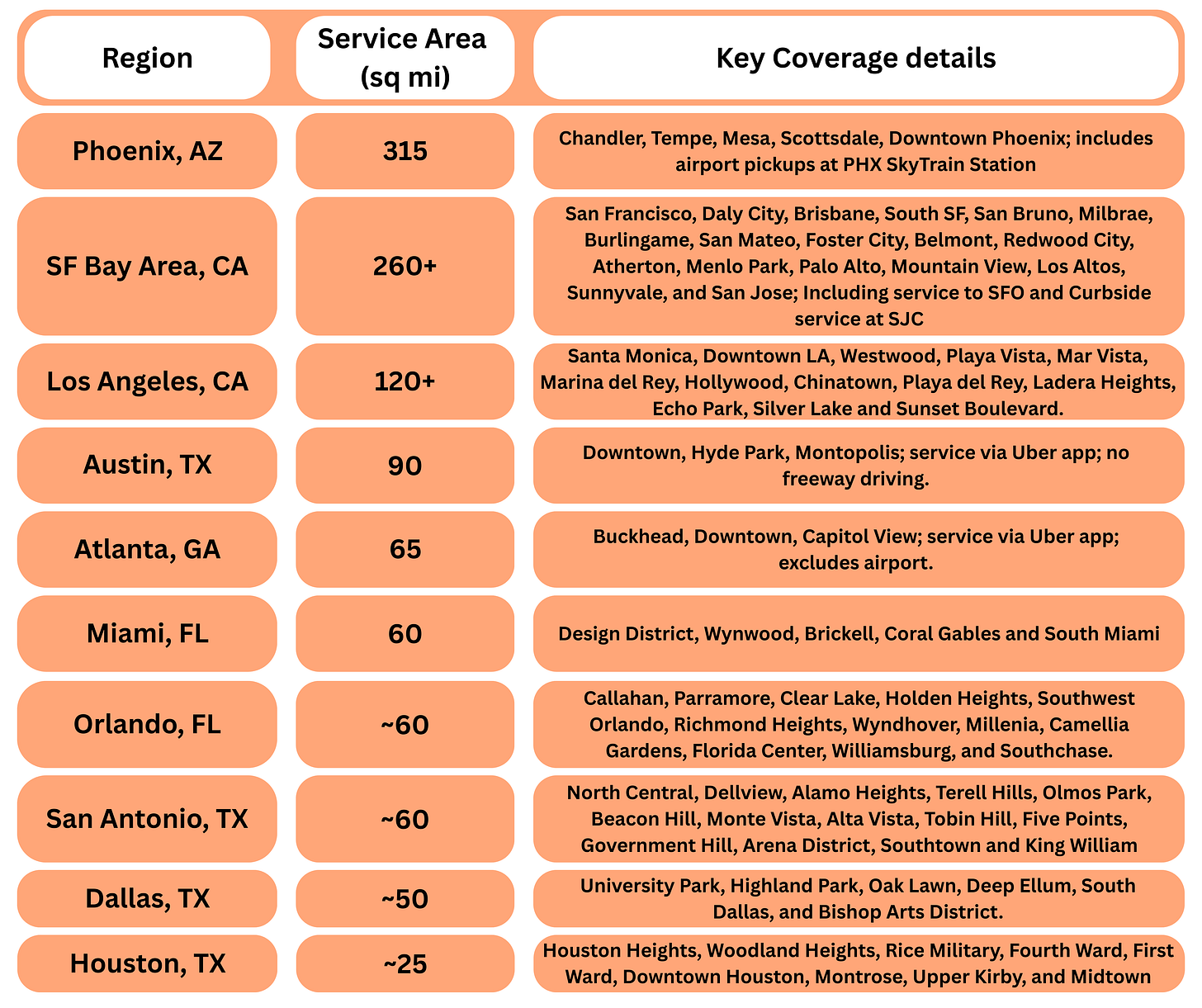

Service Areas

Waymo currently has a cumulative operating area of 1,100+ square miles, across ten major coverage areas.

315 square miles in Phoenix, including freeways.

260+ square miles in the San Francisco Bay Area, including freeways (link, no paywall).

120+ square miles in Los Angeles, including freeways.

90 square miles in Austin.

65 square miles in Atlanta.

60 square miles in Miami.

~ 60 square miles each in Orlando and San Antonio.

~ 50 square miles in Dallas.

~ 25 square miles in Houston.

Rides in Miami, Orlando, San Antonio, Dallas and Houston are currently only available to a small group of riders through the Waymo One app. You can view maps of all the active service areas here — except for Austin and Atlanta.

Future/announced markets

Chicago and Charlotte

On February 25, 2026, Waymo announced they’d started laying the groundwork for future autonomous service in Chicago and Charlotte. They started with manual testing and mapping with safety drivers, and will move toward fully driverless operations and eventually open up ride-hailing to the public.

Sacramento and Boston

On February 5, 2026, Waymo announced its expansion into Sacramento and Boston to lay the groundwork for future service in both cities. No official launch timeline has been announced yet.

Baltimore, Pittsburgh and St. Louis

On December 3, 2025, Waymo added Baltimore, Pittsburgh, and St. Louis to its list of future launch cities, announcing manual testing in the three cities as a first step toward eventually launching fully autonomous rides there.

Minneapolis, Tampa and New Orleans

On November 20, 2025, Waymo announced the beginning of manual drives in Minneapolis, Tampa and New Orleans, leading up to their expected launch of public rides in 2026

Detroit, Las Vegas, and San Diego,

On November 3, 2025, Waymo announced plans to launch service in Detroit, Las Vegas, and San Diego, initially rolling out a mix of self-driving Jaguar I-Pace and Zeekr RT vehicles for testing, with public rides expected in 2026.

London

On October 15, 2025, Waymo announced plans to bring it’s robotaxi service to London. They will start testing with safety drivers behind the wheel before rolling out fully in 2026, once regulators give the green light. Their London fleet will use Jaguar I-PACE EVs powered by the Waymo Driver system, with Moove handling day-to-day operations and maintenance.

Nashville

On September 17, 2025, Waymo announced a partnership with Lyft to bring robotaxis to Nashville in 2026 (link). As part of this deal, Lyft will be Waymo’s fleet partner through their Flexdrive subsidiary and riders will be able to book rides through either the Lyft or Waymo app.

Denver

On September 2, 2025, Waymo announced the start of testing in Denver, their coldest city to date. There were no partners in this announcement, and they plan to launch service here in 2026.

Seattle

On September 2, 2025 (same day as Denver announcement), Waymo also announced the start of testing in Seattle. Just like Denver, they didn’t announce any partners here, and didn’t specify a future launch date for service.

Washington DC

On March 25 2025, Waymo announced their service will be available for riders in Washington, D.C in 2026 through the Waymo app. The announcement came just a couple months after they resumed testing in the capital back in January.

Road Trips

Road trips are different from ‘future/announced markets’ and according to Waymo, the purpose of a road trip is to drive in “regions where the driving culture and conditions differ from the areas we regularly operate.” So it does not necessarily mean they will launch in these markets any time soon.

New York and Philadelphia

In their update on July 7, 2025, Waymo announced that their road trips have kicked off in New York and Philadelphia, with vehicles now driving around in both cities (link). They also announced the beginning of autonomous testing in Philadelphia on December 3, 2025.

Tokyo

On April 10 2025, Waymo announced they’d begin data collection in Tokyo with driver-operated test rides (link). The goal of this is to map the city and better understand the local roads, infrastructure, and driving habits. This road trip stood out because it marked the first ever introduction of the Waymo driver to international roads. They also highlighted they do not have plans to serve riders in Tokyo at this time.

Weather

Waymo’s deployments/announcements have been a mix of cities with relatively good weather and a few others like New York, Miami and Atlanta with relatively high rainfall. September 2025 marked the announcement of their first true cold weather market, Denver (average seasonal snowfall of 56”), where they plan to launch in 20265.

Market Share

Waymo is growing rapidly as evidenced by their trip growth above, but they are still a small fraction (450,000 trips per week) of Uber’s global market share (250 million trips per week).

San Francisco

Yipit has released periodic data on Waymo’s market share in both SF and Austin. In December of 2024, Yipit reported that Waymo’s market share was equal to Lyft’s in SF (link) but the caveat was that it was only for trips that started and ended in Waymo’s operating domain. So trips like those to the airport, which is outside of Waymo’s operating area, did not count in this analysis.

The initial report was also strongly denied by Lyft’s CEO David Risher in their Q4 2024 earnings call and the CEO maintained that their market share in SF is relatively flat due to the fact that Waymo is actually growing the overall market share.

In June 2025, Yipit released updated data indicating that Waymo had overtaken Lyft’s market share in the city (link). However, the same caveat around Waymo’s operating area remains.

Austin

Yipit also released data on Waymo a few months into the ‘Waymo on Uber’ launch in Austin and the company claimed that Waymo was doing close to ~20% of Uber rides within its operating zone (link). Again, the big caveat with this data set is that it only counted rides that started in Waymo’s operating area (37 square miles at the time, it’s now up to 90) - leaving out major hot spots like the Austin Airport. At the metro level, Yipit found that Waymo made up just 6% of all Uber rides.

It’s also important to note that in Austin, Yipit shared the percentage of Waymo rides as divided by total Uber rides. Whereas in SF, they provided Waymo’s market share divided by the total rideshare market (including both Uber and Lyft rides).

Here’s a detailed analysis of this data set that we performed for Austin.

All Markets - Our Market Share Analysis

Using proprietary analysis and our own assumptions, we came up with the following rides/day and market share figures.

Methodology

Using publicly available ridehail data for both Uber and Lyft in the cities of Chicago and New York City, we extrapolated the total ridehail market using population data for each city.

We then used Waymo’s trip level data from the CPUC in California and Waymo’s publicly released total weekly trip number as at April 2025 (250,000) to estimate rides per day in their top 4 markets and calculate market share.

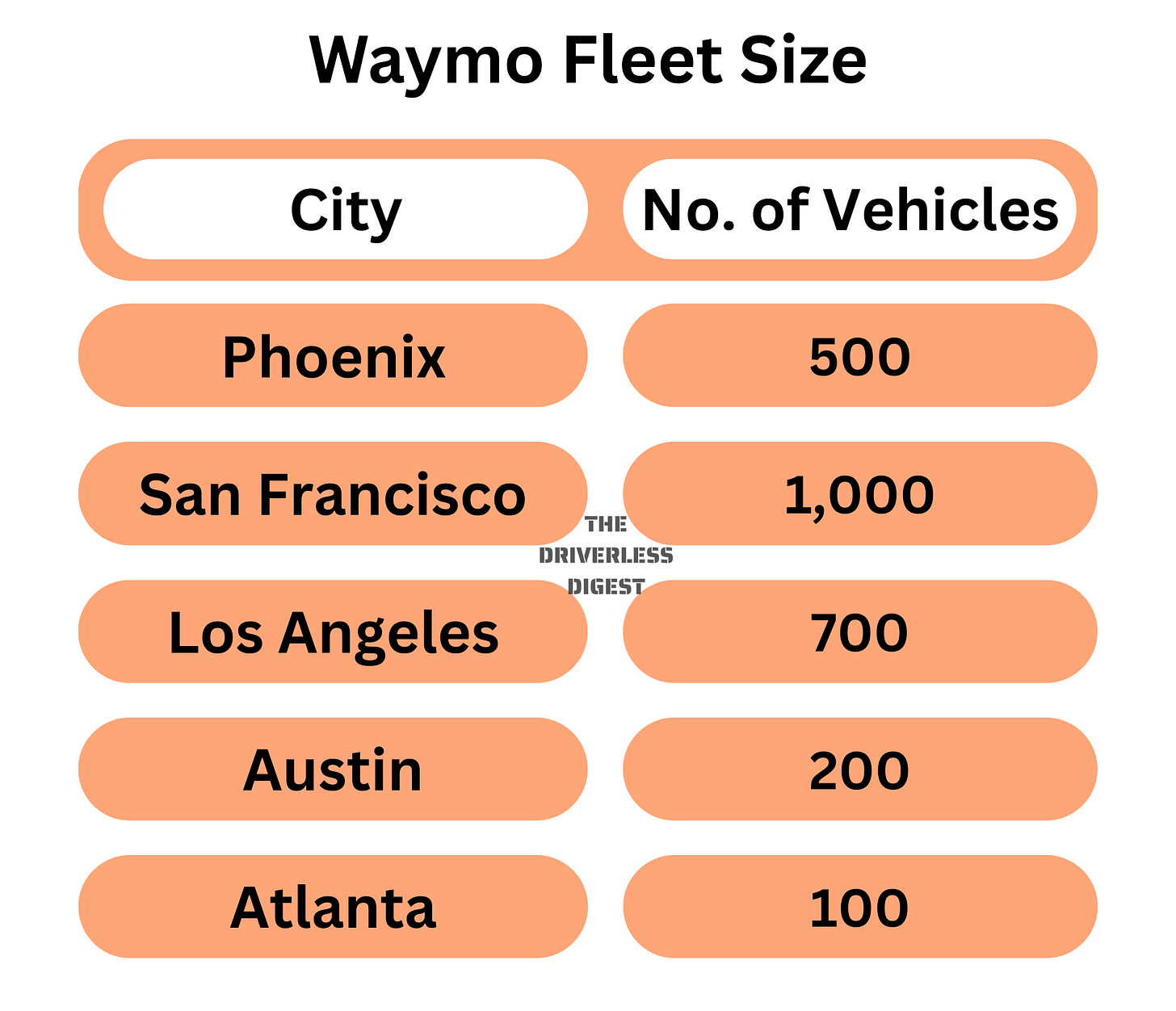

Vehicles/Fleet Size

Waymo’s current commercial fleet is made up of Jaguar I-PACEs with Zeekr RTs expected to join soon. Hyundai IONIQ 5s are also slated to join the fleet in the future.

As at November 2025, they had 2,500 commercial vehicles in the U.S (link, no paywall), with a bulk of them in California.

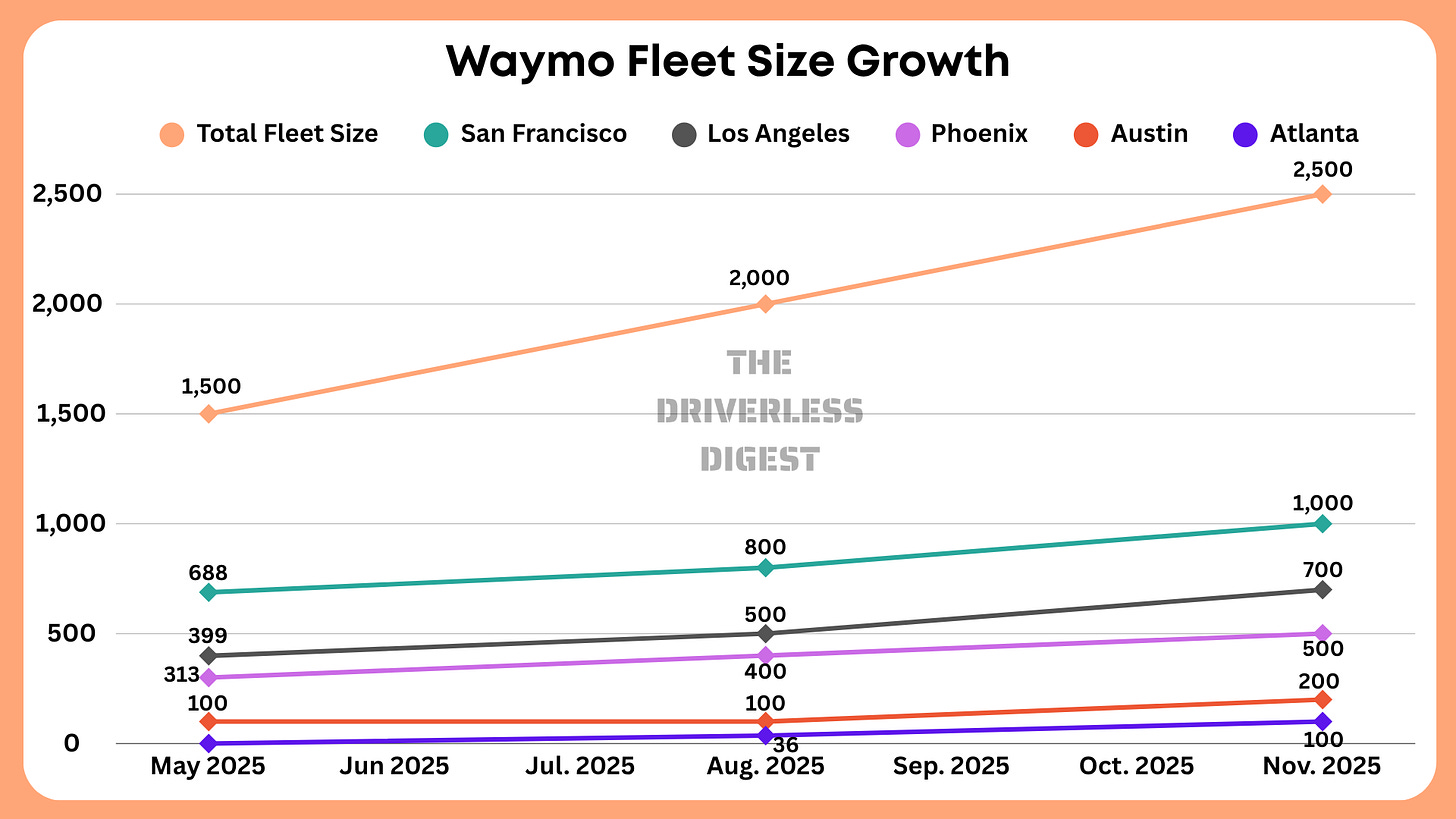

Fleet Growth

Here’s how Waymo’s fleet has grown between May to November 2025:

Waymo Vehicle Cost

Waymo’s current public operating fleet is made up solely of Jaguar I-Paces, with an MSRP of $75,000. These vehicles are then retrofitted with a full suite of sensors — including LiDAR, radar, and cameras — giving them a 360° view of their surroundings. According to Waymo co-CEO Dmitri Dolgov, the hardware on their fifth-gen robotaxis adds up to $100,000 to the cost (link, no paywall), bringing each vehicle’s total to about $175,000. That’s a big step up from your average UberX vehicle, which is on average, a vehicle like an 8-year-old Prius worth closer to $30,000.

Waymo also plans to add Hyundai IONIQ 5s and Zeekr RTs to its public fleet, both significantly cheaper than the Jaguars, and that should reduce the total cost of each vehicle. Zeekr RTs have already began employee rides in San Francisco and Los Angeles (link).

Robotics expert Chris Paxton has estimated the cost of the Zeekr to be around $75,000.

Waymo Pricing

Obi, an app that compares real-time prices and pickup times across ride-hailing platforms, released what it describes as the first detailed analysis of Waymo’s pricing strategy (link). The study found that Waymo’s autonomous rides are about 30-40% more expensive than similar trips with Uber or Lyft — yet that higher cost doesn’t appear to be deterring riders.

Obi pulled nearly 90,000 ride offers in SF between March 25, 2025 and April 25, 2025 to compare pricing and ETAs across Waymo, UberX, and standard Lyft rides. Lyft came out cheapest with an average of $14.44, followed by Uber at $15.58. Waymo was the priciest, averaging $20.43 for the same routes and times.

During peak hours, Obi found that Waymo rides were, on average, around $11 more than Lyft and about $9.50 more than Uber.

I had Obi CEO, Ashwini Anburajan on the podcast to discuss this data, among other things (link).

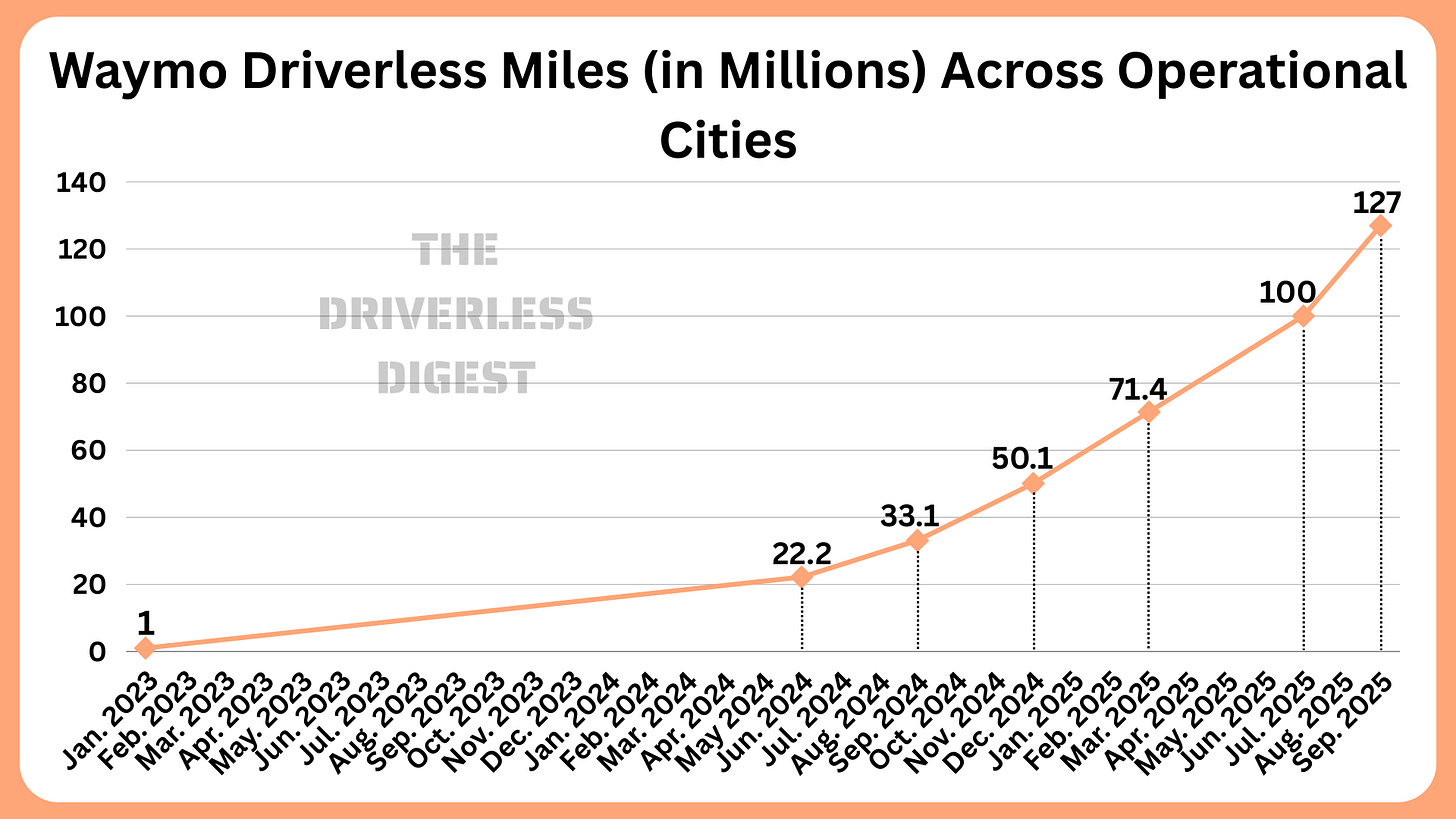

Waymo Passenger Miles

On December 16 2025, Waymo updated their safety hub with data from over 127 fully autonomous miles driven on public roads, through September 2025 (link)6.

Safety

According to a Swiss Re study (link, no paywall), Waymo vehicles saw 88% fewer property damage claims and 92% fewer injury claims compared to the average human driver. Over 25.3 million autonomous miles (no safety driver), the Waymo Driver racked up just nine property damage claims and two bodily injury claims (which are still under review in the report). For comparison, human drivers would typically face 78 property damage claims and 26 injury claims over the same distance.

Waymo One launch date (link). Waymo Co-CEOs: Dmitri Dolgov and Tekedra Mawakana.

I nulled out the growth in June due to Waymo’s reduced LA and SF operations because of protests/vandalism/etc. (also confirmed partially by CPUC data).

We didn’t feel that it was appropriate to continue extrapolating LA vs SF market share beyond 3 months, since the expectation is that LA will eventually reach an equilibrium point relative to SF.

You mentioned that SF is densely populated. I presume more SF use taxis because it's cheaper going short distances than owning. I live in car centric Calgary, pop. 1.5M, but it's not near other dense populations. Do you think the Cdn market cities like Calgary will be added after another year, since there are only 9 US cities with that size of population? Will every city take a lot of testing before rollout?

Awesome post. Will you keep updating each quarter? Very curious to see LA in particular