Waymo’s Master Plan

Analyzing Waymo's current business, operations and partnership strategy and what's to come..

This article has been updated from the original version I published back in October 2024 and includes the latest Waymo x Lyft partnership news in Nashville!

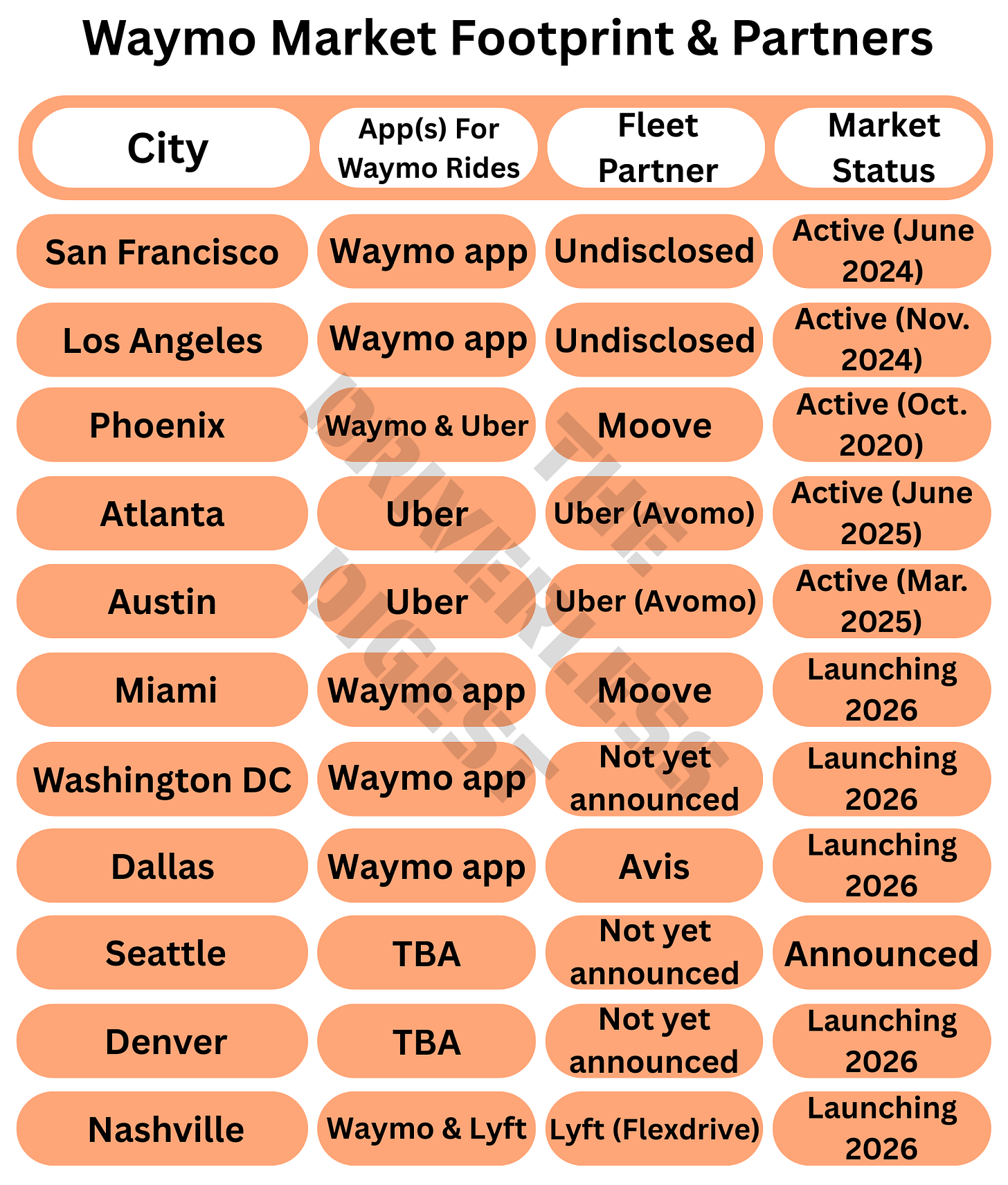

Waymo is currently doing over 250,000 rides per week across 5 major cities: San Francisco, Los Angeles, Phoenix, Austin, and Atlanta. But the company’s most recent launches were exclusively on the Uber app in both Austin and Atlanta, with a product known as ‘Waymo on Uber’.

Rideshare passengers in Phoenix have been able to hail a Waymo via the Uber app since October 2023, but they also have the option to book a ride directly through the Waymo app. In San Francisco and Los Angeles, Waymo is only bookable through the Waymo app. Waymo has also announced six new markets with a variety of partners like Avis, Moove and Lyft but Uber is the one company missing from all of those new cities.

For the casual observer, this may seem like a confusing mix of options, but it’s all part of ‘Waymo’s Master Plan’. The company is experimenting with different business models and lots of different partners through all aspects of the value chain. It’s still too early to pick winners but it is clear that Waymo is open and willing to partnering with a number of different companies on everything but the AV technology. This partnership strategy makes a lot of sense when you think about the DNA of Alphabet (its parent company) - they are a technology company, not a hardware and operations company.

With a partnership model, Waymo is able to focus on the ‘Waymo Driver’ and offload all of the hard parts of running a rideshare company to other parties. Rideshare is a difficult business, especially when you have to own and operate a fleet of expensive and quickly depreciating vehicles. Waymo doesn’t need to do any of that though.

In today’s post, I’ll explain Waymo’s different operating models and touch on where the business may be headed and why.

Waymo vs Uber (First Party Rideshare)

Current Locations: San Francisco and Los Angeles

Logistics: Riders need to download the Waymo app, and they can only call for a ride via the Waymo app.

With this business model, Waymo is competing directly with Uber. That means they need to run a rideshare company (a la Uber) and they are ALSO responsible for acquiring, owning, operating, maintaining, charging (they work with partners like Terawatt in Los Angeles for example), storing, etc (the list goes on and on) their vehicle fleet.

Fleet ownership is a tough business though. When Uber made its foray (no paywall) into the physical world of vehicles with Xchange leasing, they estimated a loss of $500 per car, but ended up with a loss of $9,000 per car. Multiply that times a 40,000 vehicle fleet and you get a $360 million loss for Uber (in 2017 dollars no less). Ouch.

Waymo has 2,000 vehicles on the roads right now, but imagine what would happen once they scale to 20,000 or even 200,000 cars. The problem with fleet economics is that as you scale, your risk also scales, and there are a number of factors beyond your control. Just ask Hertz who has had major issues with their fleet of Teslas as the value has crumbled thanks to continual price cuts. And remember, Hertz is an experienced fleet operator who is supposed to ‘know what they’re doing’.

I’m also not sure there’s a ton of upside for Waymo with a first party model. During busy times, Waymo can charge ‘surge pricing’ a la Uber, but they have a fixed fleet so there’s only so much they can increase prices without facing potential backlash. Typically, surge pricing is used to curb demand AND increase supply. Waymo isn’t able to increase the latter since they have a fixed fleet size.

So Waymo may want to exercise caution in raising prices too high during peak demand times. Can you imagine the headlines if Waymo starts charging $500 for a ride home on a Saturday night on a normally priced $20-30 ride? And of course there’s competition from companies like Uber and Lyft, so Waymo can’t charge too much more otherwise folks will opt for competitors. Remember, AVs are supposed to make rideshare cheaper :)

The other issue I’ve seen with Waymo is high ETAs, especially in less dense markets like Los Angeles. There’s a lot of demand and not enough supply, so the common refrain I’ve seen is that all Waymo needs to do is scale up their fleet and ETAs will come down. But since demand is elastic, this may not happen anytime soon. As Waymo scales up their supply, this will induce more demand. And if you scale up supply enough to meet peak demand on a Saturday night, you’ll have too many cars on Tuesday afternoon. This is why there were only 13,000 taxi cabs in NYC for so long (there are now over 100,000 rideshare vehicles in NYC).

So with this model, Waymo has limited upside and massive potential downside from owning the fleet.

Waymo and Uber / Lyft (Hybrid Partnership)

Locations: Phoenix and Nashville (announced - coming in 2026)

Logistics: Phoenix - Riders can request a Waymo ride from either the Waymo app or the Uber app.

Nashville - Riders can request a Waymo ride from either the Waymo app or the Lyft app. Lyft will also manage the Waymo fleet via its Flexdrive subsidiary.

From Uber’s announcement in 2023:

How to ride with an AV: Starting today in Metro Phoenix, riders who request an UberX, Uber Green, Uber Comfort, or Uber Comfort Electric may be matched with a Waymo vehicle if the route is part of Waymo’s newly expanded operating territory—which includes Sky Harbor International Airport’s 24th St and 44th St SkyTrain locations—and a dedicated Waymo vehicle is available.

Update your Ride Preferences: Uber customers in Phoenix who are excited about riding in an autonomous vehicle (AV) can increase their chances of being matched with an AV by opting in via the Ride Preferences section of their Uber app under Settings.

What’s interesting here is that there’s no ‘Uber AV’ option, but instead it’s an opt-in/preference. Request an UberX ride and if you’ve opted in; if there’s a Waymo available/with a comparable ETA (I’m guessing); and IF your route is in Waymo’s service area, you will get matched with a driverless rideshare vehicle.

Those are a lot of restrictions but it also highlights why Waymo plugs in so perfectly into Uber and Lyft’s marketplaces. Rideshare companies are great at maintaining liquidity in their marketplace. They’ve been doing it for over a decade and the number one KPI has always been a 3-5 minute ETA when riders open the app. That’s why Uber and Lyft have surge pricing, which seems customer unfriendly on the surface, but means you’ll always have a driver available. Most drivers would rather sit at home on a Saturday night, but if I can earn more money through surge pricing, I’ll get off the couch and hit the road.

For Uber and Lyft, this type of partnership with Waymo adds additional, high quality, safe (from an insurance perspective), consistent and reliable supply (frankly areas where the Uber/Lyft product has deteriorated over the past 5 years). All of which are valuable for Uber and Lyft, since it fills in baseline demand, and then their variable supply of human drivers can handle peak demand times like it always has.

Even though Waymo has shown with their first party operations that it’s been relatively easy to get tens of thousands of people to download their app, I like this blended approach since Waymo is plugging into an existing well-oiled machine. So Waymo power users can always get a Waymo if they’re willing to wait longer and pay more by using the Waymo app. For Uber and Lyft users, the experience is also better since they’ll be matched with a Waymo if/when it meets certain criteria. If there are no AVs available, they’ll get a human driver just like they normally would. I could even see a model where Waymo fills in their app with Uber/Lyft drivers when they need extra supply.

The big benefit for Waymo with this hybrid model is the boost in demand during off peak times. In Nashville, they also get to offload fleet management to Lyft (unlike with Uber in Phoenix). Lyft is a strong fleet partner since they actually own and operate 15,000 vehicles through their Flexdrive subsidiary so the company has real fleet management experience unlike Uber, which merely outsources fleet operations to Avomo in Austin and Atlanta. So this could be a big leg up for Lyft over time since they can provide value on both the demand and fleet operations side.

Waymo Provides Vehicles to Uber (Third Party)

Locations: Atlanta and Austin

Logistics: Riders can only request a Waymo ride from the Uber app and Uber is responsible for generating demand, and cleaning and maintenance of the vehicles.

This is the most recent evolution of Waymo’s master plan and I think it’s the best business model so far since it allows the company to focus on improving their technology and reducing costs, while outsourcing most of the hard parts of the business to Uber.

Even though Waymo has shown they can generate plenty of demand themselves and that their riders are willing to wait longer and pay more, Uber helps them increase utilization (which is the number one metric in the fleet business) in a few big ways:

Lower ETAs - Uber operates at a high density with hundreds of thousands of trips per day in tier 1 markets, so that means any request for a Waymo will be within a 3 to 5 minute ETA (we call this Period 2, drive time to the passenger pick-up after a request). And Waymo also gets to cherry pick the best trips.

No downtime - On Uber’s network, Waymos will never have any downtime. Period 1 (online, waiting for a request) is costly since you’re literally just sitting there waiting for a ride. Uber knows their baseline demand in all scenarios and can effectively forecast for Waymo to fill all of those rides. This also leverages the asset well since there’s no human driver to get tired and you really only need the Waymo Driver to take a break for cleaning and charging. Uber’s demand is especially valuable during off-peak times (10 pm - 6 am) since we know Waymo has struggled with generating demand during those times (hence the discounts they often offer).

Expanded domain - Waymo is geo-fenced in every city, can’t go on freeways, struggles with certain pick-up/drop off locations, and has limited airport access (only PHX and SJC). This is a bad experience for passengers if they’re looking for a reliable rideshare app. But with Uber, you can set a Waymo preference and any time a trip falls out of Waymo’s operational domain, you’d get a human driver without having to check another app. Frankly, a much better experience for the average customer.

This deal is huge for Uber right now since they get exclusive Waymo access in two cities and have a great answer to investors who are worried about AV disruption. For Waymo, they have shown they don’t need Uber in the short term, but I’m sure they’re gathering a lot of interesting data on utilization and revenue with this model compared to their first party cities.

I like to think of this setup as the ‘franchise model’ where Waymo may still own and operate a few key markets but the majority of the business will be licensed out to other players and they just provide the key components/supplies/etc.

Waymo’s Future Markets and Partners

Locations: Miami, Washington DC, Dallas, Seattle, Denver and Nashville.

Uber has been a curious omission from all six of Waymo’s announced markets after Atlanta and Austin:

9/13/24 - Waymo on Uber announced for Atlanta and Austin.

12/5/24 - Waymo announced Miami market with fleet partner Moove but no mention of Uber.

3/4/25 - Waymo launched in Austin - exclusively on Uber.

3/25/25 - Waymo announced Washington DC as the next ‘Waymo One’ market - rides to begin in 2026. No Uber or fleet partners were mentioned in the announcement though.

4/9/25 - We started getting positive data back from Waymo x Uber Austin launch (just one month after the launch).

5/7/25 - Uber CEO, Dara Khosrowshahi, says Waymos in Austin are busier than 99% of human drivers

6/24/25 - Waymo launched exclusively on Uber in Atlanta, just like in Austin.

7/28/25 - Waymo announces Dallas launch with Avis as their fleet partner, and no Uber.

9/2/25 - Waymo announces beginning of testing in Seattle and Denver, ahead of a future launch in both cities.

9/17/25 - Waymo announces Nashville launch with Lyft as their App partner and fleet management partner.

Uber is Waymo’s exclusive partner in Austin and Atlanta but since they don’t own a single vehicle or have any experience in fleet management, they outsource those responsibilities to their partner Avomo in those two cities. In Phoenix and soon to be Miami, Uber-backed Moove provides fleet operations for Waymo.

A lot was made of the Miami and Washington DC announcements since Uber was not included, but it was before we had any indication of the success of the ‘Waymo on Uber’ launch in Austin (and Atlanta) so I wouldn’t read too much into that other than Waymo was still keeping their options open.

The big surprise for me was the omission of Uber for the Dallas launch. Avis does have a ton of experience with on the ground operations though and according to CEO Brian J. Choi:

In the City of Dallas alone, we manage a fleet of over 15,000 vehicles spread across 50-plus sites maintained by dozens of technicians and service by a field team of over 500 individuals. We’ve been doing this day in and day out for over 75 years.

Waymo doesn’t partner with Uber for their expertise in fleet management though; instead they look to Uber to generate massive demand. And according to all indications, the Austin launch had been going well with Waymo providing 20% of all Uber rides on the platform just 1 month into the partnership with only 100 vehicles. So why did Waymo ditch Uber for the Dallas launch?

Uber still has a strong partnership with Waymo in Austin and Atlanta, and numerous other AV partners, but that may also be the problem. Uber benefits from a fragmented AV market and is investing and partnering with over a dozen other players while Waymo has shown that they don't necessarily need Uber to be successful.

Seattle and Denver were announced with no partners mentioned, unlike past launches (Avis in Dallas, Moove in Miami, etc). But the big surprise was the Lyft and Waymo partnership in Nashville where Lyft will handle both demand and fleet management through their Flexdrive subsidiary. This bodes well for Lyft but now marks six new markets that Waymo has announced without Uber.

Waymo to Partner with ‘Fleet Owners’ or OEMs

Logistics: OEMs or fleet owners purchase the ‘Waymo Driver’ stack up front and can then plug their vehicles into Uber, Lyft or build a mobility platform of their own (terrible idea, but I’m sure a few of them will try it).

What if I told you there was a way that Waymo could cut all of their capital expenses, operating expenses and just focus on selling a software product with infinite margins?

Waymo’s closest announcement of this model was with Toyota, in April 2025. One caveat though from the announcement is that the companies didn’t disclose any concrete deliverables, guarantees or financial investment.

In Waymo’s previous OEM announcements with Zeekr and Hyundai, they appear to bear most of the financial risk, and this makes sense since Waymo’s tech is still expensive. But I wouldn’t be surprised if each successive deal has more and more favorable financial terms for Waymo. There was news that Moove may be financing a fleet of Waymo vehicles but there have been no reports of that financing round closing.

I think we’ll know that the ‘Waymo Driver’ has a potential path to profitability on a unit economics basis when an OEM or fleet owner buys the hardware stack from Waymo, puts it on their vehicle, pays a monthly SAAS subscription to Waymo and starts giving driverless rides.

This type of partnership may be close and seems like the best outcome for Waymo since they don’t have any control over the cost of the vehicles and I’m not sure they want to get into the car business with a vertical integration. OEMs on the other hand have shown that they love investing billions of dollars in the next big mobility thing so why not Waymo?

What do you think about Waymo’s different partnerships and business models? Which option would you pick?

-Harry @ TDD

Very helpful, thanks! Nothing else I've read so carefully address who undertakes the capital investment, and your analysis also helps me to think through the benefits of partnerships with Uber/Lyft for increasing capacity utilization. I will be using this as a framework for thinking about Baidu Apollo, Tesla, WeRide, Pony.AI and others. (I read Chinese, albeit slowly...) For example, I don't know if the AV entrants partner with DiDi; I now see how critical that is, both for utilization, and for letting ride hailers see a quick response time, something direct services can't.

Great article exploring the different scenarios. Seems like Waymo is still exploring which path to take but will be interesting to see how this develops.