Waymo: The 2024 King of Robotaxis

Waymo releases early safety stats, an explanation for Lyft’s market share fumble in SF, what happens when you’re harassed in a robotaxi, and Waymo hits the freeway in Phoenix.

Waymo is now offering $10 off your first ride! Click here to secure your discount (only 10 redemptions left).

Top Stories of the Week

Waymo dominated the U.S. robotaxi market in 2024, but Tesla and Amazon’s Zoox loom (link). This is a great recap of the autonomous landscape over the past year and there’s not much for me to add. I’m excited for Zoox to launch and add a little competition for Waymo but realistically, they’re more like Sidecar than Lyft (anyone get that reference?).

The only step function change I can see happening in 2025 is if Tesla were to launch some type of robotaxi service. I think this is unlikely though, and the earliest it could happen would be 2026. Elon, prove me wrong!

Waymo vehicles saw 88% fewer property damage claims and 92% fewer injury claims compared to the average human driver, according to a Swiss Re study (link). Over 25.3 million autonomous miles (no safety driver), the Waymo Driver racked up just nine property damage claims and two bodily injury claims (which are still under review in the report). For comparison, human drivers would typically face 78 property damage claims and 26 injury claims over the same distance.

Impressive numbers for Waymo here but I’m always skeptical of large data sets that are released like this in ‘partnership’ with a third party. If the numbers would have been bad, would Waymo still have published this report? I doubt it.. But this is a positive sign for Waymo on the safety and insurance front. Meanwhile, Uber and Lyft are spending insane amounts of money right now on insurance costs and focused on getting these numbers down. Down the road, this could be a big differentiator when it comes to unit economics.

Robotaxi riders in San Francisco targeted with a new form of harassment (link, no paywall). In cases of harassment from pedestrians or other motorists, like those highlighted in the above article, the absence of a human driver is a big issue. Still haven’t heard or seen a good solution for these situations and it’s not the first time it’s happened.

Waymo vehicle hits Phoenix freeway at higher speed with first true passengers (link). First video I’ve seen of Waymo doing actual driverless rides on freeways and if they took a journalist along for the ride, I’m guessing they are feeling confident. I wouldn’t be surprised if Waymos started operating on freeways in the next month or two.

Cool Rides

First Waymo ride. Enroute to Salesforce Park (link).

I rode a Waymo with my 6-year-old twins. The experience was fun but the use cases feel limited (link).

Experiencing Waymo’s driverless car for the first time in LA. Great experience, definitely more confident than Tesla FSD (link).

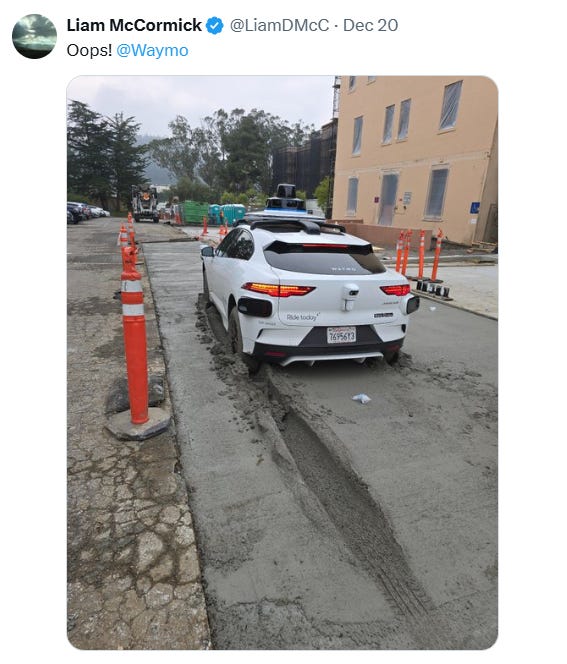

AVs behaving badly

I feel like these types of edge cases will never go away. Luckily for now though, there haven’t been any that are too dangerous. Just amusing :)

Other Stuff

Check out the Waymo exhibit at the Petersen Automotive Museum! The models and graphics are incredible (link). I might need to take my kids on a field trip :)

I’m not a big stock picker/follower but apparently, Uber’s stock price isn’t doing so well lately. If the drop is due to competition from Waymo and Tesla, I think that is misguided. Mario’s thread provides a nice overview of Uber’s advantages but in my opinion, the biggest/most important advantage Uber has over Waymo is their variable supply. Uber does not have to pay for down time for its vehicles, and can scale supply up during times of high demand when you also have the highest potential margins/revenue. To me, this is the biggest thing folks outside of the shared fleet industry do not understand.

I'd feel better about the competitive dynamics for Lyft in San Francisco vs Waymo if the % of rides being discounted wasn't >50% and the avg fare discount hadn't skyrocketed to >8% (link). I’ve been talking to a lot of folks about the Waymo vs Uber/Lyft market share data over the past couple of weeks and the best explanation I’ve found for Lyft’s drop in market share is that it’s no longer the second choice for dual app-ers. Before Waymo, most customers defaulted to Uber, but there was a large percentage that would also check Lyft. Same drivers, same ETAs, so if the price is cheaper on the latter, it’s a no-brainer, and only takes a few seconds. Now though, I think the price shoppers are going between Uber and Waymo. And since it’s such a hassle to check a third app, not as many rides for Lyft - which would explain their bigger drop in market share. What do you think?

Until next year :)

-Harry