15 Charts That Explain the Autonomous Vehicle Industry

Today’s post comes from Jackson Lester, an experienced mobility product manager who closely tracks AV operations and deployment data on AV Map.

I’m fascinated with autonomous vehicles (AVs) because more than anything else in my 10+ years working in transportation tech, AVs have the potential to make car-dependent communities, like where I grew up, livable, even dignified, without owning a car. And although the AV industry has been “five years away” for more than a decade, the numbers from 2024 and 2025 tell a different story.

Kai Williams, of Understanding AI, recently published “16 charts that explain the AI boom“. It’s a great piece that visualizes the scale of what’s happening in AI infrastructure. I wanted to do something similar for robotaxis here on The Driverless Digest.

I started mapping robotaxi deployments at AV Map a few months ago. This piece visualizes some of what I’ve learned about the industry. It’s hard to capture all of autonomous vehicle progress in one illustration though, so here are 15.

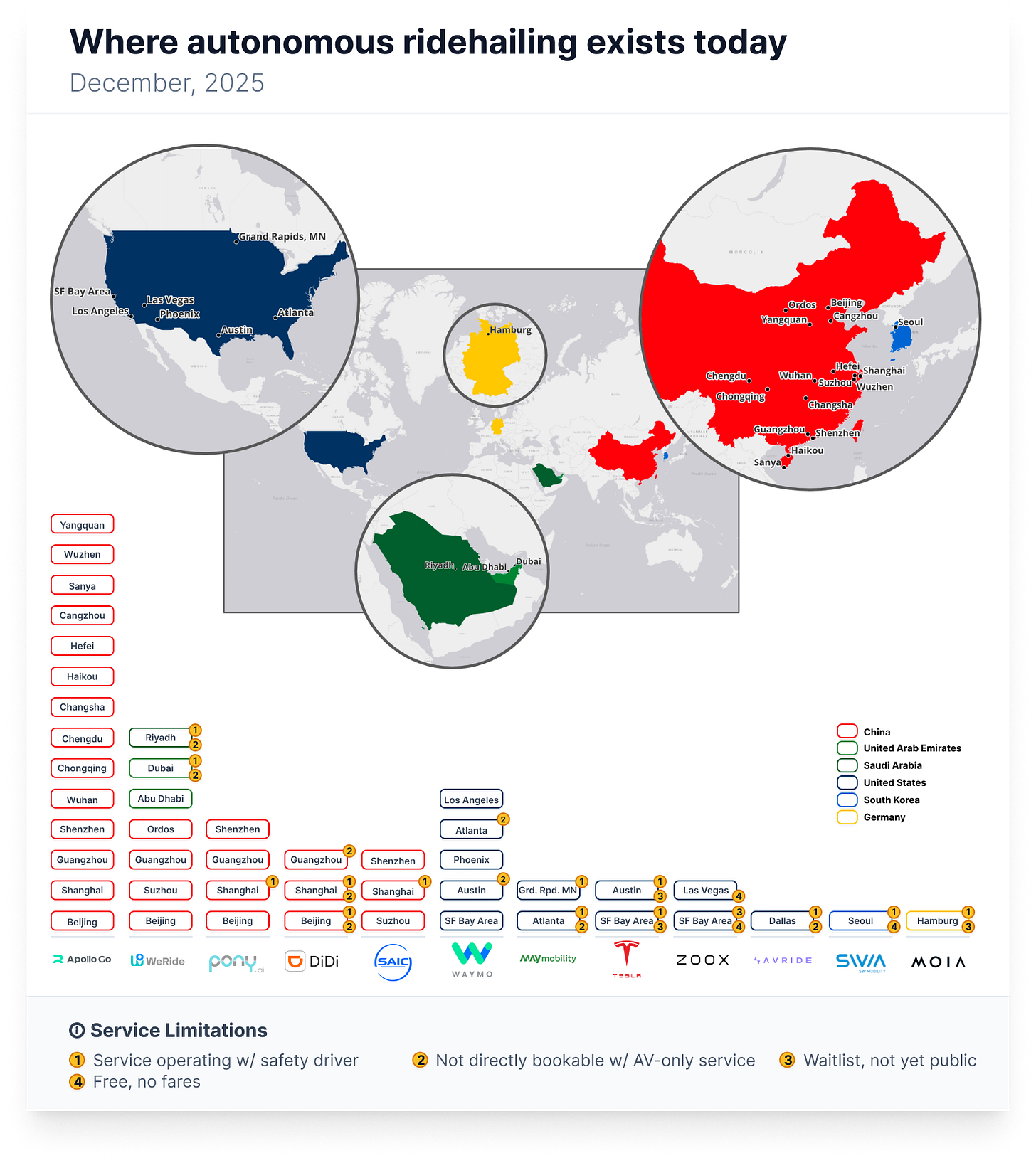

1. Where you can ride a robotaxi today

I created this graphic to show where you can ride in an autonomous ridehailing vehicle today, inspired by a June 2025 piece from Marcus Lu and Miranda Smith at Visual Capitalist.

The contrast between availability and competition in China compared to the rest of the world is striking. Chinese cities have four competing robotaxi services operating in Beijing, Shanghai, and Guangzhou, and three in Shenzhen. Apollo Go, WeRide, Pony.ai, DiDi, and SAIC are fighting for market share, pushing each other to improve service and drop prices. Outside of China, only Waymo is operating a real commercial service. No services are directly competing for the same riders yet. In the graphic below, if no service limitations are indicated, then driverless rides are provided without safety drivers, are directly bookable, and charge fares.

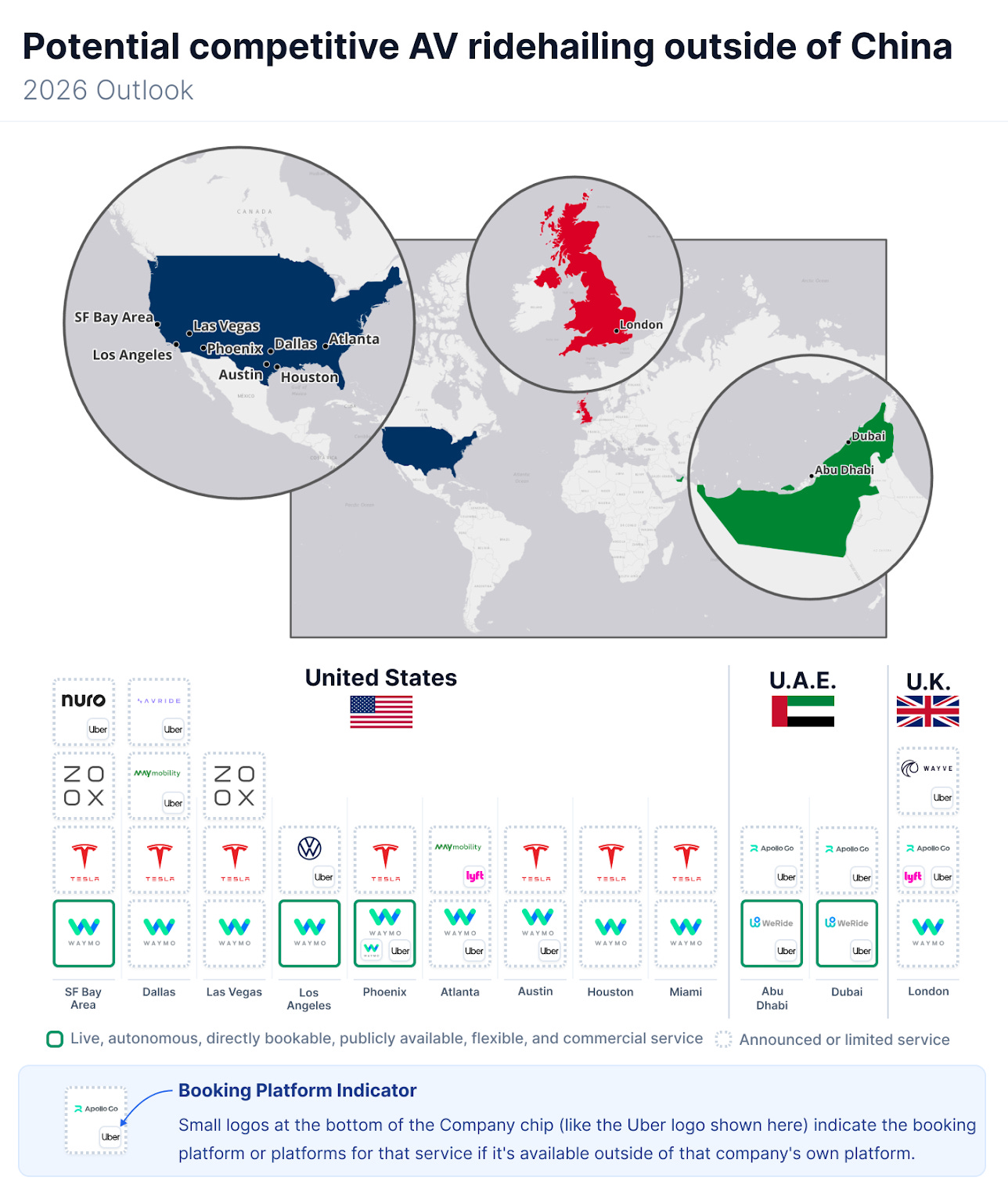

2. Competitive robotaxi ridehailing will move Westward in 2026

China has had competing robotaxi services since 2022, with multiple companies offering driverless rides in the same cities, directly bookable, and charging fares. Outside China, only Waymo has cleared that bar. Zoox and Tesla are still working with waitlists, safety drivers, or both. 2026 could change this, but a lot needs to go right. Waymo plans 12 new cities. Zoox and Tesla need to clear their respective hurdles in SF and Austin.

But if multiple AV providers operate on the Uber platform in the same city, riders won’t be choosing between them, Uber’s algorithm will. That’s different from the competitive model operated in China, where riders pick which company’s app to open and make arrangements with the company directly. Without direct competition, the benefits that China has experienced will likely be slower in coming, but availability through familiar platforms like Uber may also increase AV ridership more quickly.

If even half of this plays out, Western riders could have robotaxi options in a handful of cities by late 2026. The graphic below shows where1.

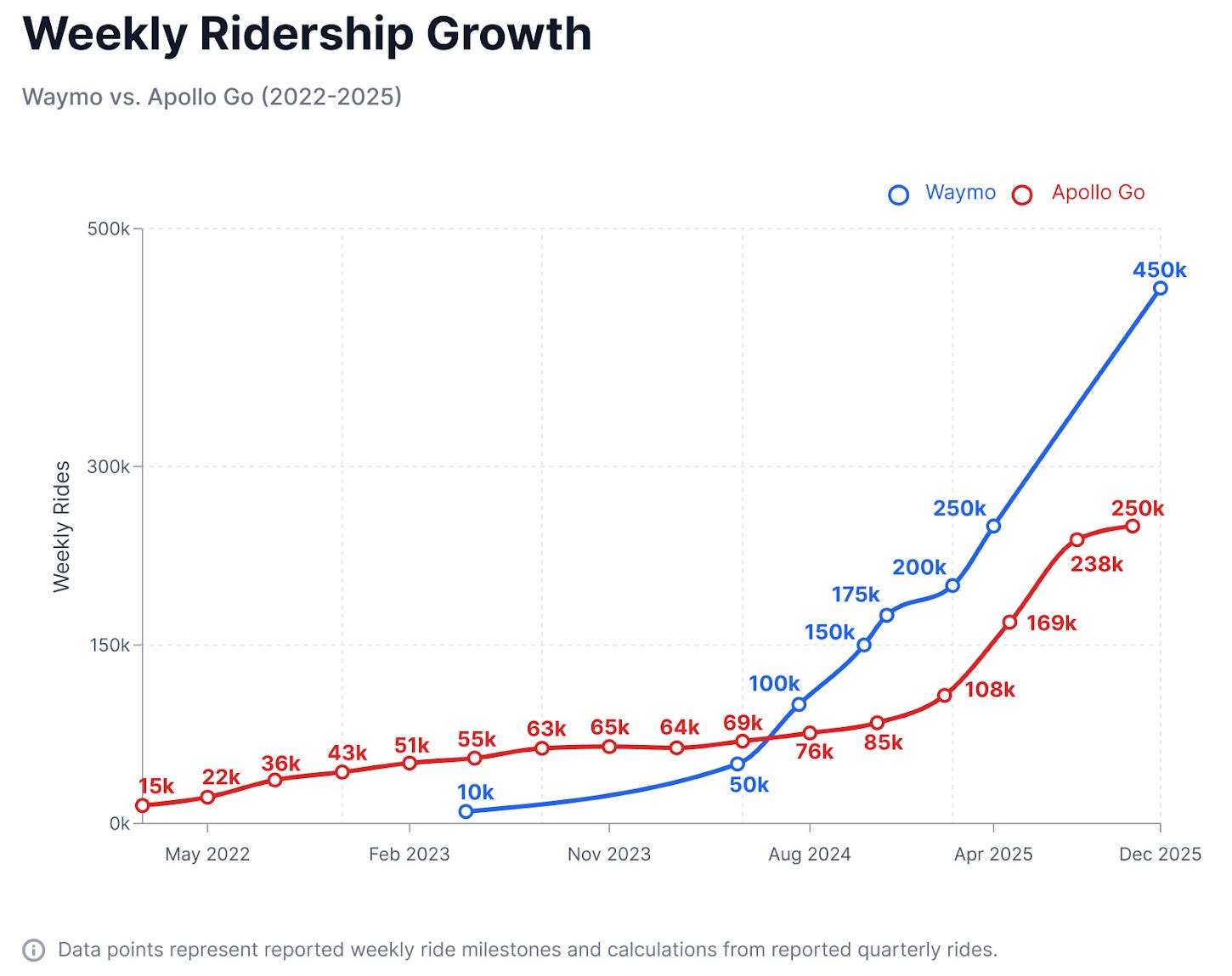

3. Robotaxi ridership from the leading companies is growing fast

Waymo and Apollo Go are the clear leaders in the US and China respectively, and the comparison is natural. Both are subsidiaries of search giants: Waymo belongs to Alphabet (Google’s parent company), Apollo Go to Baidu (often called “China’s Google”).

But the growth trajectories are different. Waymo’s curve went exponential in mid-2024 and hasn’t slowed. Apollo Go’s growth has been steadier and more linear. Today, Waymo completes nearly twice as many weekly rides as Apollo Go, despite operating in fewer cities. And the gap may widen: Waymo plans to operate in at least triple the number of markets by the end of 2026, while Apollo Go’s expansion targets have been more conservative2.

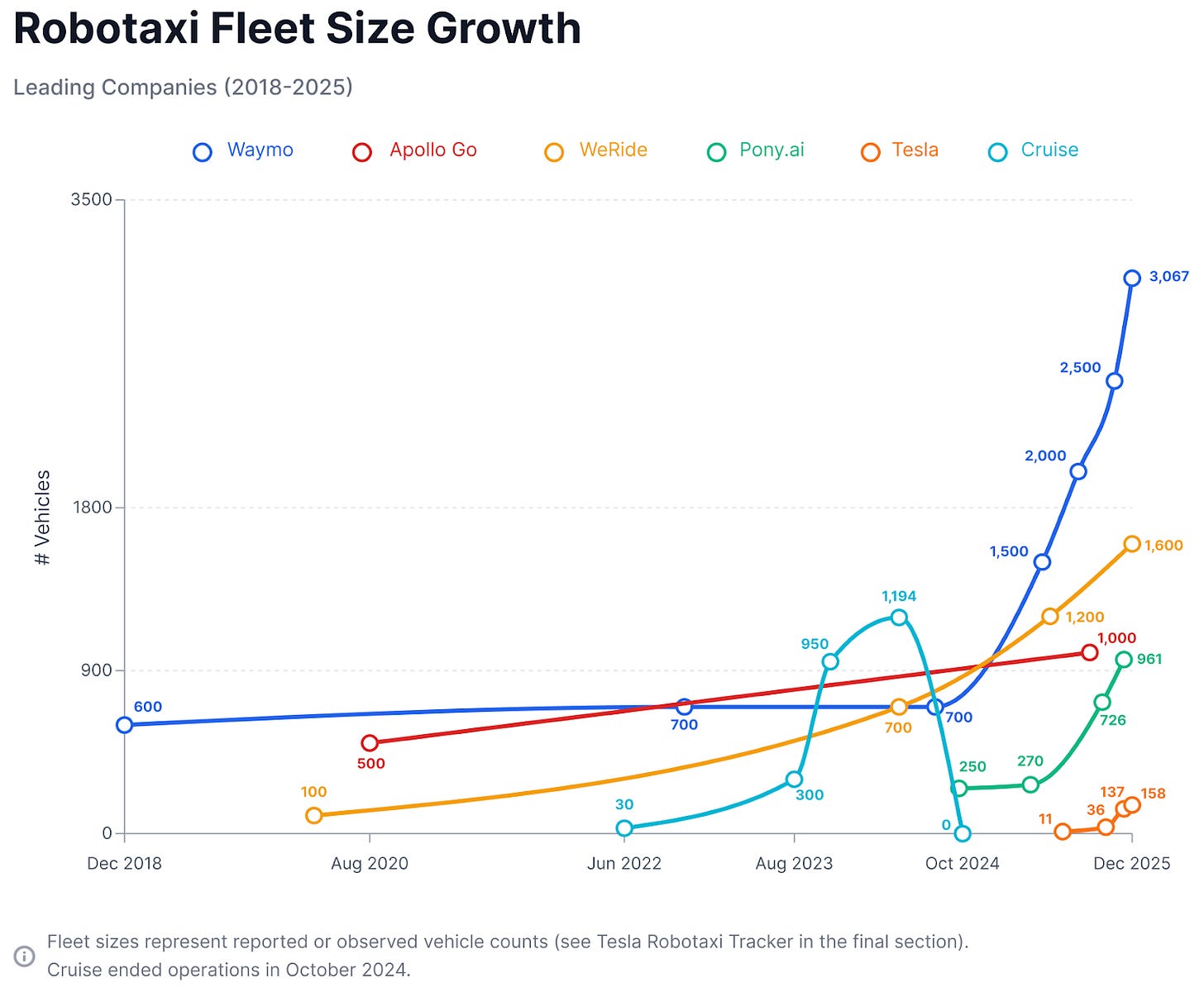

4. Leading robotaxi companies are expanding their fleets quickly

For years, most robotaxi fleets stayed small. That changed in 2024. Waymo held steady at around 700 vehicles for years, then added more than 2,300 new vehicles in the last 18 months alone. They now operate over 3,000 vehicles in the US, nearly double the size of the next largest fleet. Apollo Go sits at around 1,000 vehicles, notable given their ride volume (they’re getting more rides per car, or counting differently).

Falling hardware costs have enabled that acceleration, and scale will push them further. Waymo has also diversified its supply chain, partnering with Hyundai and Toyota alongside Zeekr.

WeRide, operating across multiple countries, has grown to roughly 1,600 vehicles. Pony.ai expanded quickly, growing from fewer than 300 to 961 vehicles in 2025 alone. Cruise’s rise and fall is visible in the data too: from nearly 1,200 vehicles in May 2024 to zero by October after pausing operations. Tesla remains small at under 200 vehicles, though they’ve grown quickly since launching in June. The reduction in vehicle costs explains a lot of this growth.

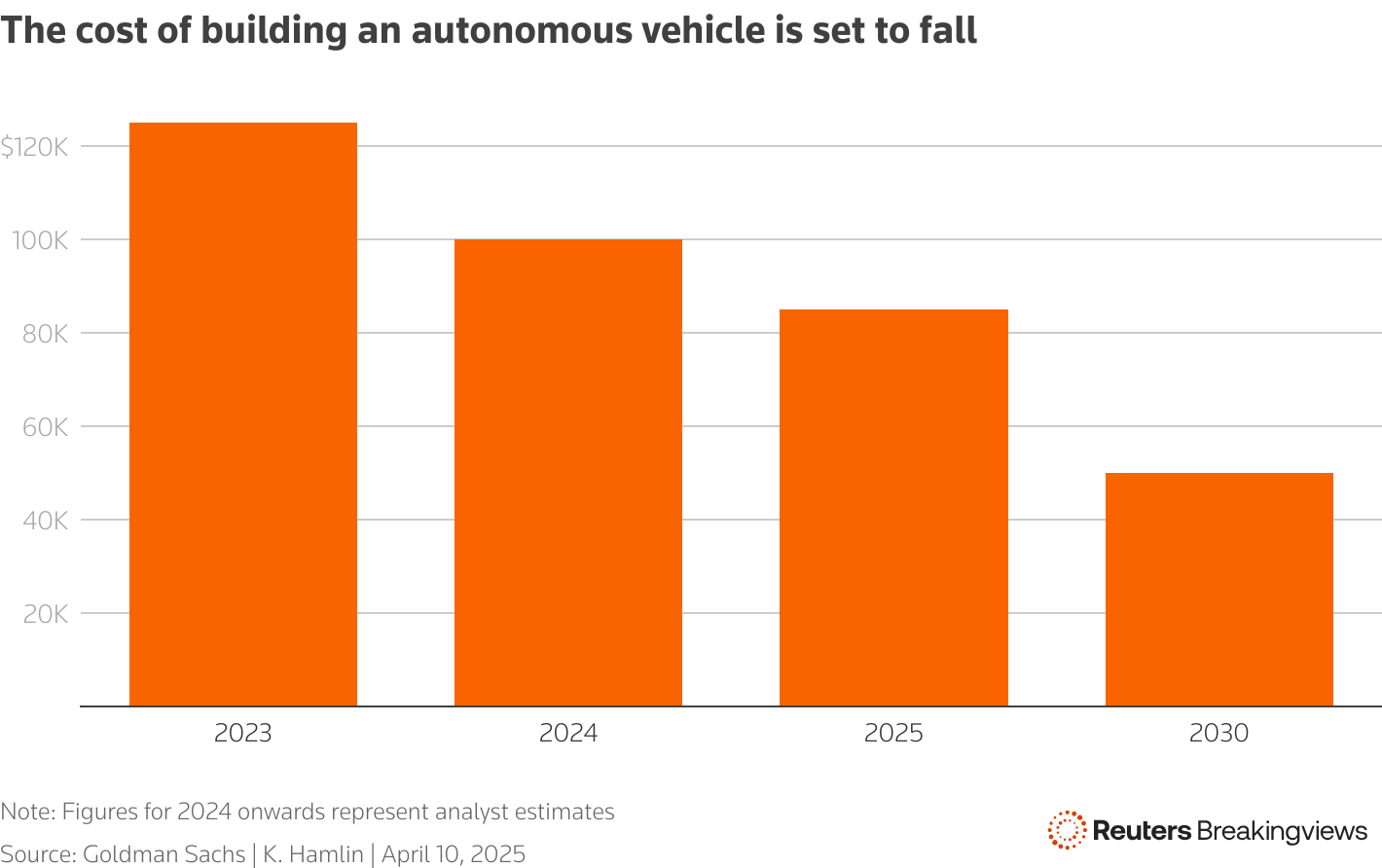

5. Robotaxi vehicle costs are coming down, and fast

Goldman Sachs projected in early 2025 that autonomous vehicle costs would fall from roughly $120,000 to $50,000 by 2030. The industry is ahead of schedule. Waymo’s new Zeekr RT is estimated to cost around $75,000, already below Goldman’s 2025 projection. Baidu’s RT6, announced in May 2024, costs around $28,000, beating the 2030 target by six years.

LiDAR is the biggest factor. When Waymo started, a single LiDAR unit cost $75,000. Today Chinese suppliers sell solid-state units for less than $200. Lower costs are making larger fleets economically viable, and that’s starting to show up in real-world competition.

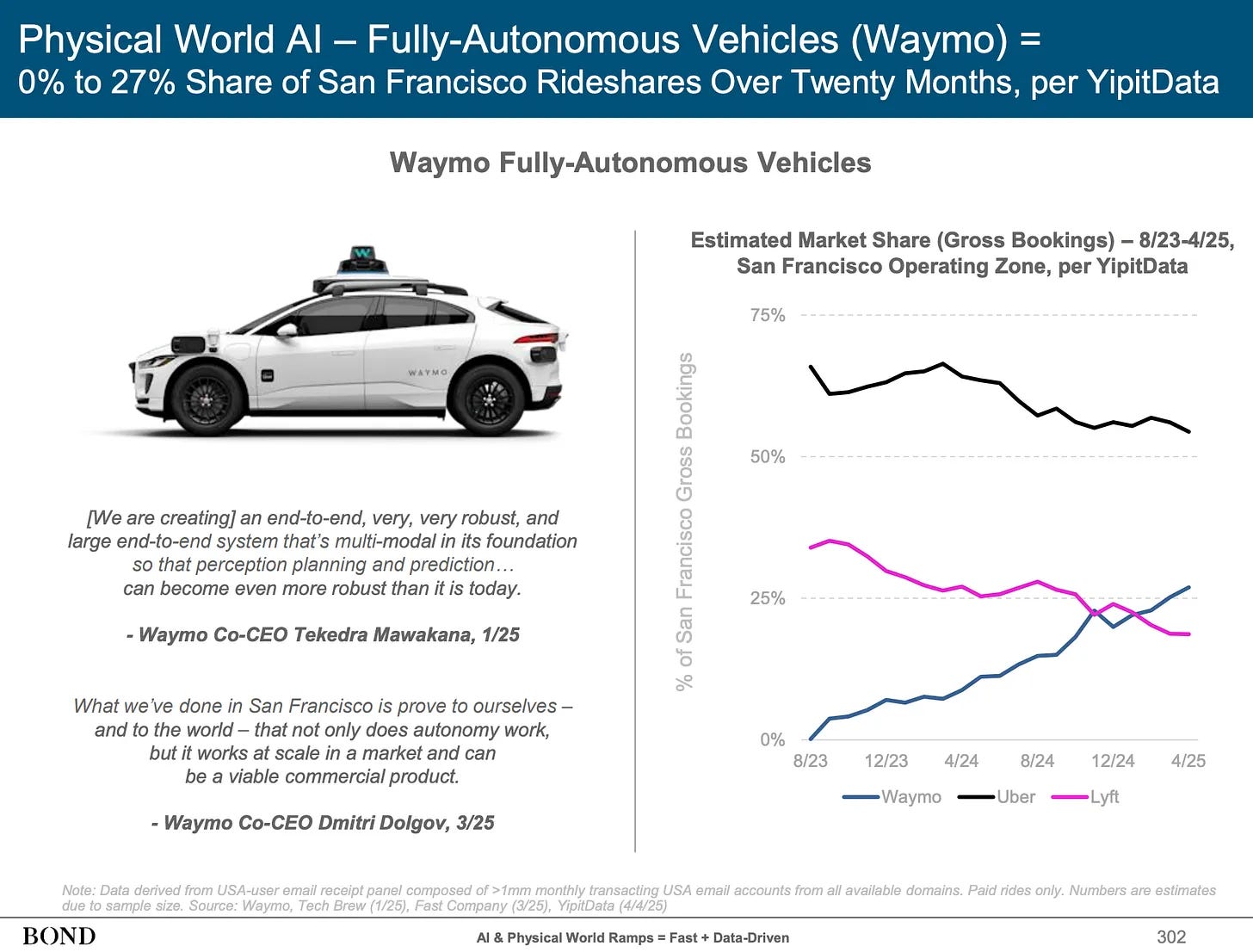

6. Robotaxis are quickly chipping away at the incumbent ridesharing market

In August 2023, Waymo had essentially zero market share in San Francisco, and they didn’t open to the general public until June of 2024. By April 2025, Waymo surpassed Lyft, capturing an estimated 20-27% of the ridehail market depending on how you measure it. And this was before Waymo expanded farther down the SF Peninsula in June 2025, before pilot testing freeway rides, and before full Peninsula (waitlist) access connecting San Francisco with San Jose.

A few caveats on the data: YipitData’s market share figures for Uber and Lyft only capture rides that start and end within Waymo’s operating zone at the time of the study, which excludes longer trips like airport runs. Other estimates put Waymo’s overall San Francisco share closer to 20%. Regardless, the data illustrates that Waymo is no longer just a novelty act competing for attention; they’re competing for rides at scale with legacy companies in the areas they operate.

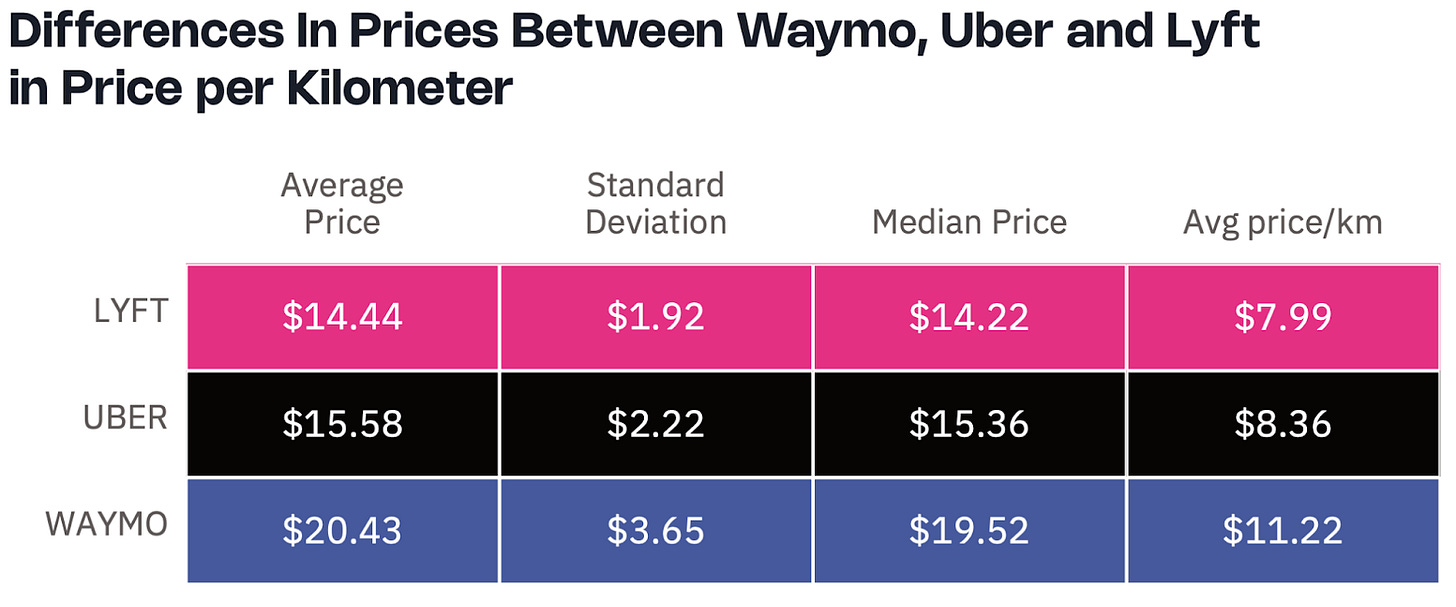

7. Waymo is gaining share while charging more

Obi is a price comparison app for rideshare that allows users to enter their origin and destination and see prices and ETAs from different providers, then deeplink into the app of their choice. Their analysis of 705 comparable San Francisco trips found Waymo price quotes 30-40% more than Uber or Lyft on the same routes. Average fare: $20.43 for Waymo, $15.58 for Uber, $14.44 for Lyft.

Given this data, it’s apparent that the growth is happening despite higher prices. I think there are two factors driving growth:

The first is novelty. Robotaxis are new and fascinating, and people want to try them. If this is the main driver, expect the growth to plateau or even fall once the curious have satisfied their curiosity.

The second is stickier: some people genuinely prefer no driver. No stranger in the front seat, no small talk, no one who learns your home address. I’ve heard this especially from women who ride alone.

Given that Waymo is still gaining market share at these prices, the preference appears real and Waymo is legitimately competing against legacy ridehailing. The next logical step is robotaxi competition in San Francisco, which will spur product innovation and lower prices for riders.

Robotaxi economics will flip at scale

Waymo can charge a premium today because they're the only autonomous option. That won't last. Zoox is expanding, Tesla is scaling, and Chinese operators are eyeing Western markets. As competition grows and vehicle costs fall, prices will follow.

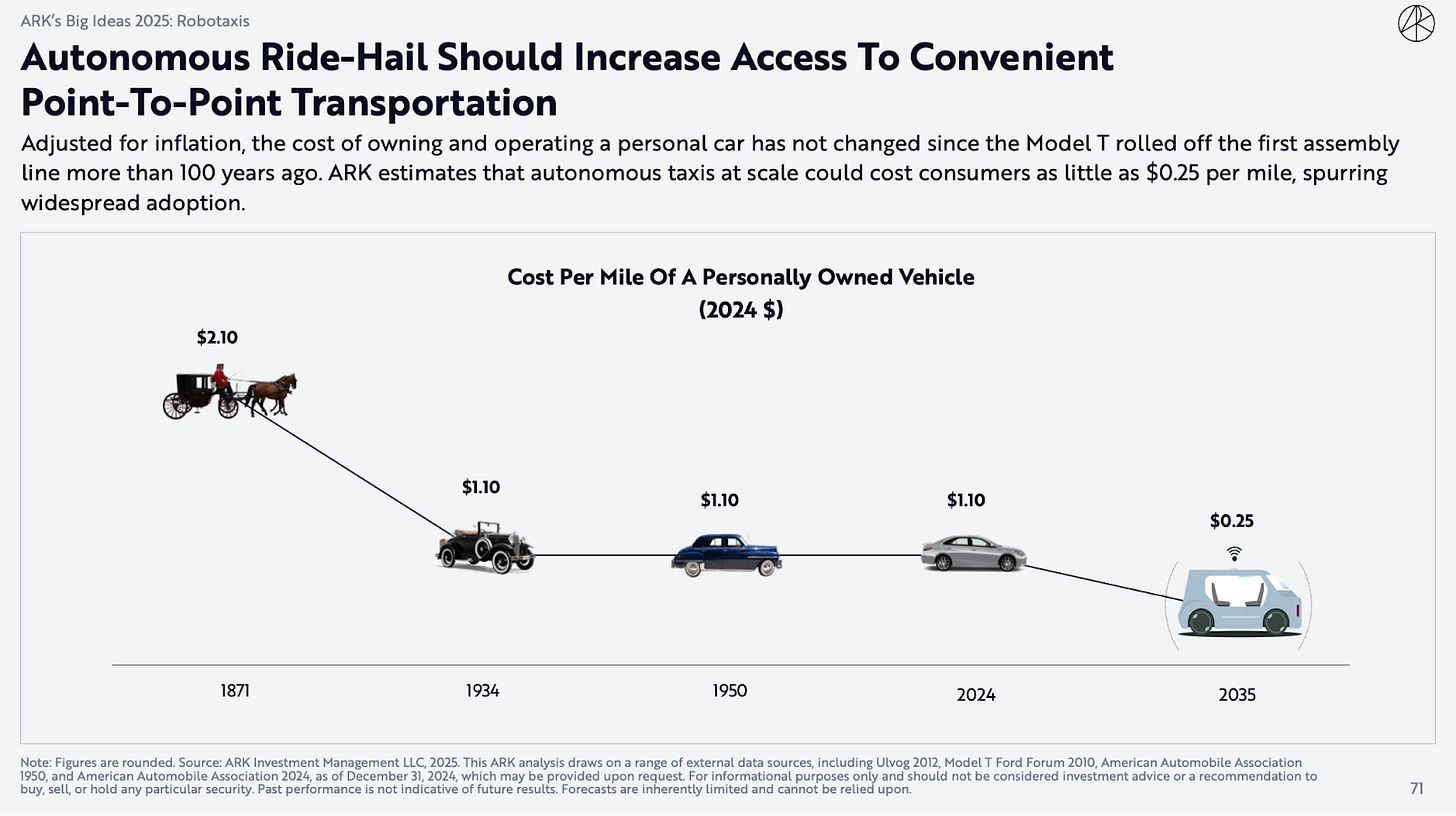

8. We’re at the brink of our next “horses to cars” moment

ARK points out that adjusted for inflation, the cost of owning and operating a car hasn’t changed much since the Model T. Ninety years, and we’re still stuck. Cars got safer and more comfortable, but not cheaper, holding steady at $1.10 per mile.

Robotaxis could change this. ARK estimates autonomous ridehail at scale could hit $0.25 per mile. This estimate is aggressive, but even conservative projections from other sources are well below the cost of car ownership. At a cost that is even close to the projections, the car sitting in your garage 95% of the time starts to look like a bad deal.

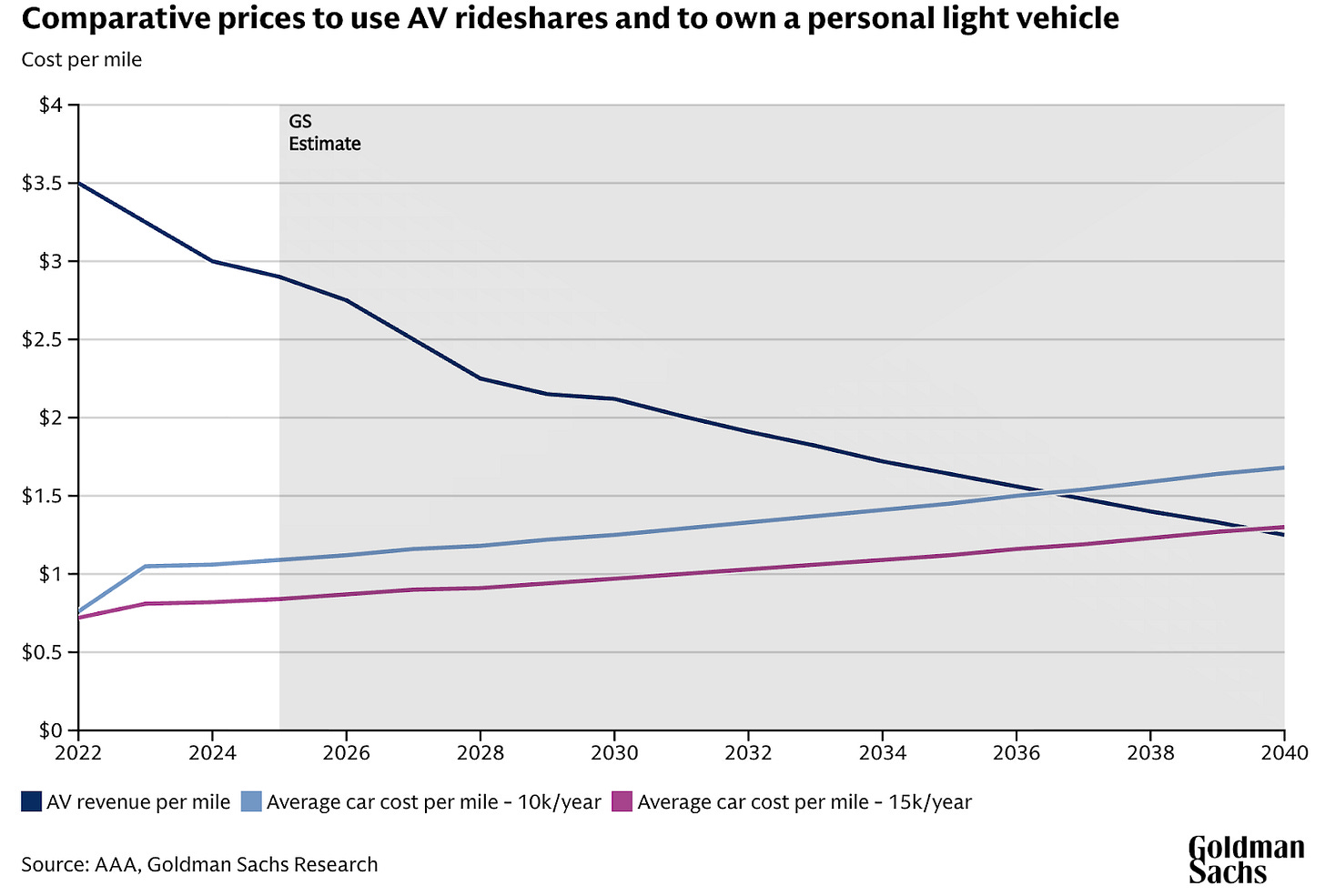

9. A critical inflection point: The cost per mile is expected to fall below driving your own car

So when does ridehail actually get cheaper than driving? Goldman Sachs projects somewhere between 2036 and 2040, depending on how much you drive. AV ridehail today costs riders around $3 per mile. Car ownership sits at $1-1.50 per mile.

The crossover comes sooner if you drive less. At 10,000 miles per year, your cost per mile is higher, and the lines cross around 2036. At 15,000 miles, closer to 2039. Either way, the crossover is less than fifteen years out.

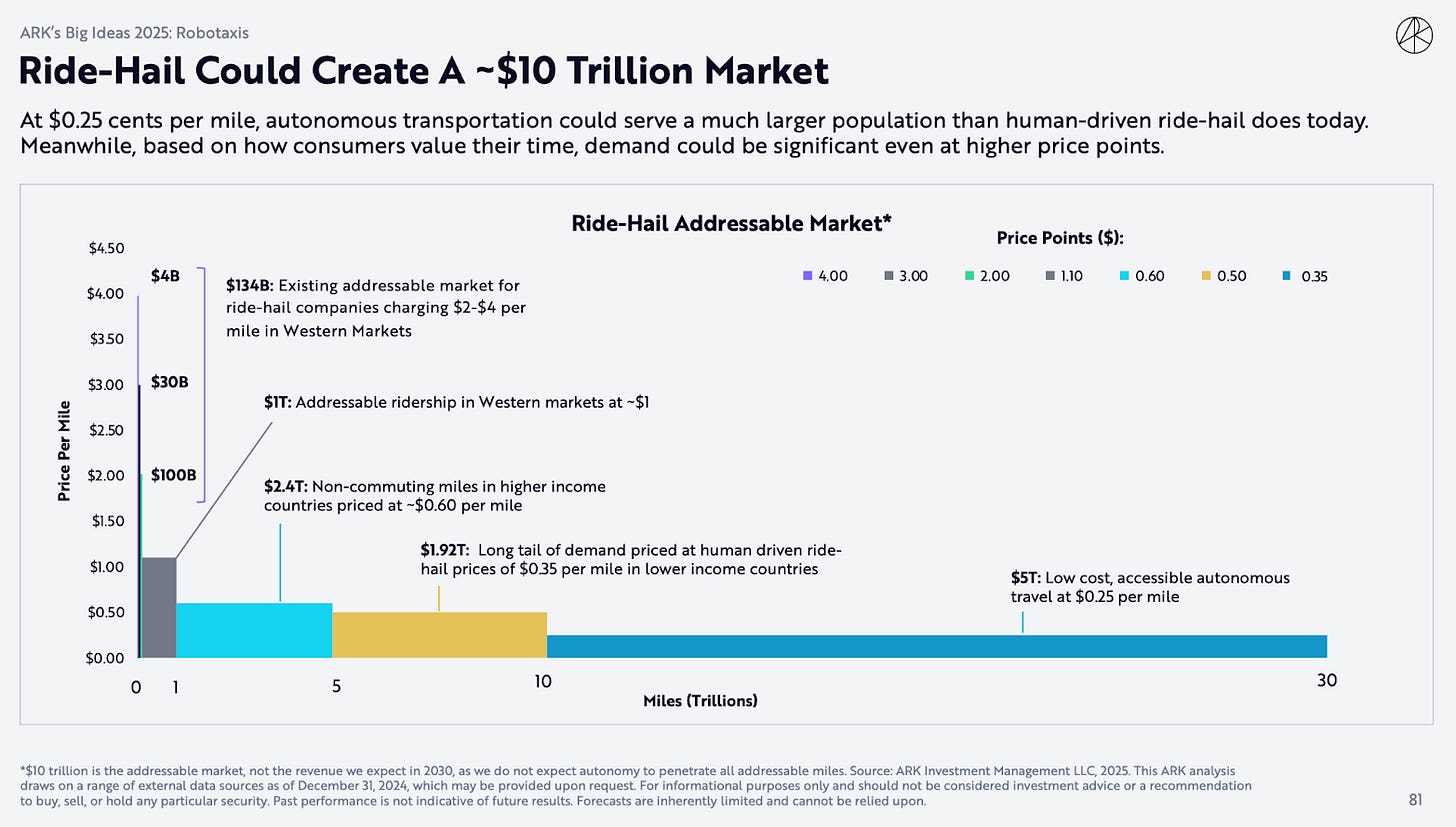

10. Lower prices unlock new riders

Price unlocks demand. At $2-4 per mile, ridehail is a $134 billion market. It serves business travelers, people heading to the airport, anyone who can expense the ride or doesn’t want to deal with parking.

At $1 per mile, ARK sees a $1 trillion market. At $0.60, it’s comparable to driving a car you already own. At $0.25 per mile, we’re starting to induce new demand and the addressable market could hit more than $10 trillion.

How far costs fall determines how big this market gets.

Who’s still betting on Robotaxis?

The last few years have narrowed the field. Apple killed its autonomous vehicle program, Project Titan, in February 2024 after a decade and billions of dollars. GM shut down Cruise in December 2024 after spending over $10B on the unit.

Cruise and Uber’s ATG program share a grim parallel: both struck pedestrians, and neither recovered. Uber’s 2018 fatality in Arizona led to a suspended program and eventual sale to Aurora. Cruise’s 2023 incident in San Francisco, where a robotaxi struck and dragged a woman who had been hit by another car, triggered a regulatory suspension and eventually GM’s decision to shut down the unit entirely. Microsoft wrote off $800M on its Cruise investment.

And yet, the world’s largest companies are doubling down. Funding has returned, though it’s flowing to fewer players than before.

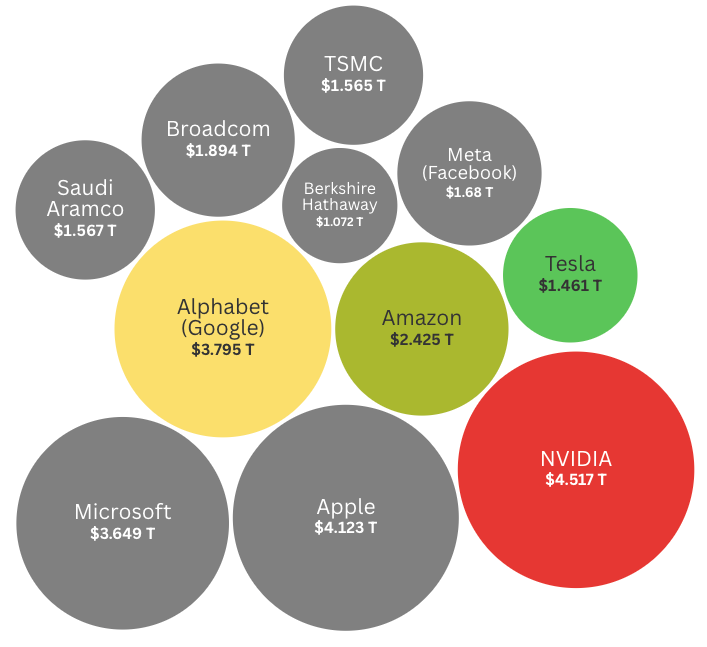

11. Four of the world's eleven trillion-dollar companies are in this race

Alphabet owns Waymo, Amazon owns Zoox, and Tesla is building its own robotaxi program. NVIDIA supplies the chips that power nearly everyone else’s systems. Waymo has absorbed an estimated $25-30B of investment since 2009. Amazon has likely spent north of $10B on Zoox since acquiring it for $1.2B in 2020, and Tesla claims cumulative autonomy investment exceeding $10B.

That’s tens of billions just to compete, from companies that don’t bother unless the upside from the investment is an order of magnitude larger.

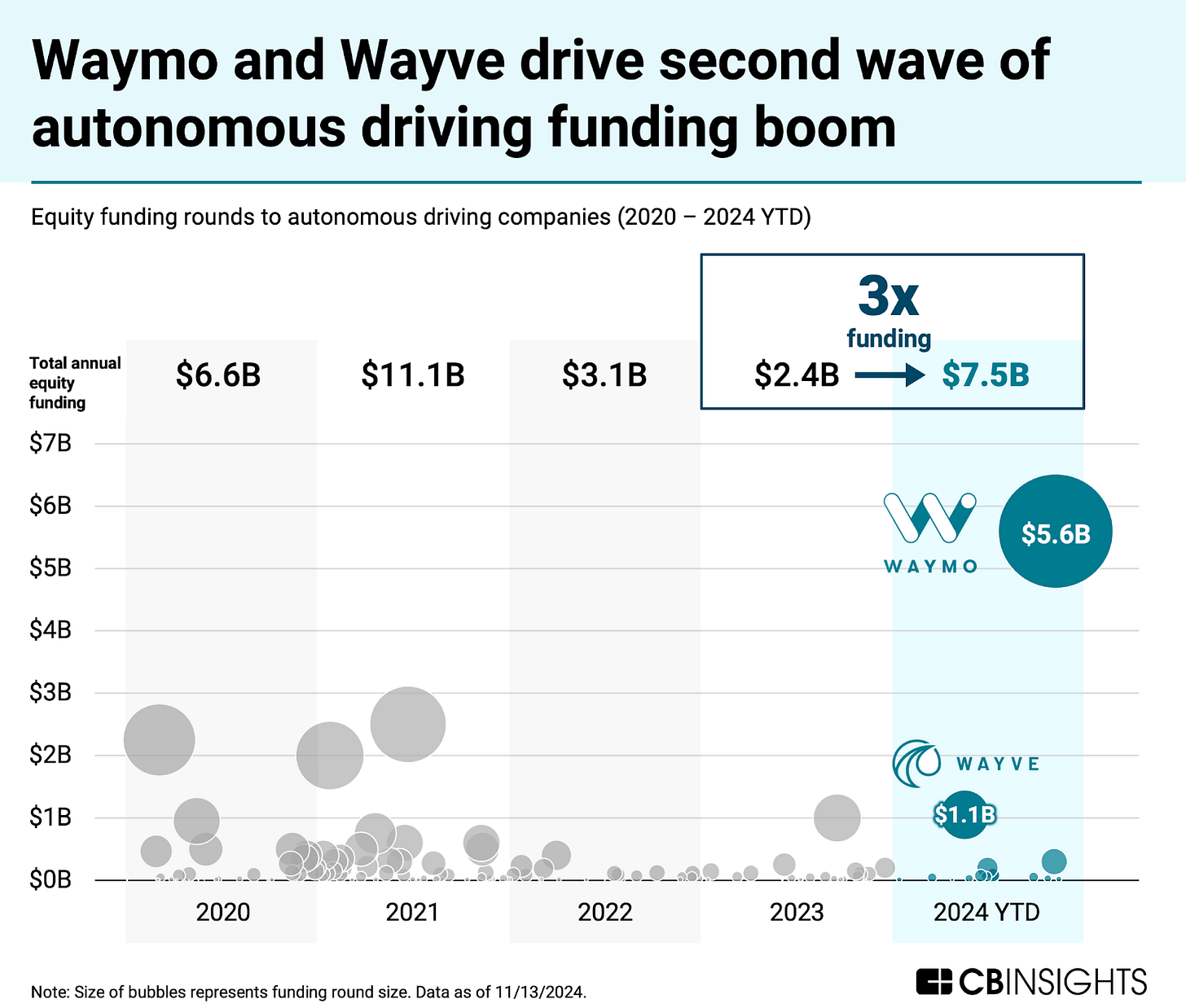

12. Funding is back, and almost all of it is going to Waymo

This CB Insights chart shows AV funding hitting $11B in 2021, collapsing to $2.4B by 2023, then tripling to $7.5B in 2024. The gray bubbles are funding to other companies. Waymo and Wayve (highlighted in teal) account for 90% of 2024's total. Waymo alone raised $5.6B at a $45B valuation. They're now reportedly raising another $15B at a valuation above $100B. That's more than double what they were worth a year ago. If that round closes as advertised, it alone would double 2024’s total funding illustrated in this chart.

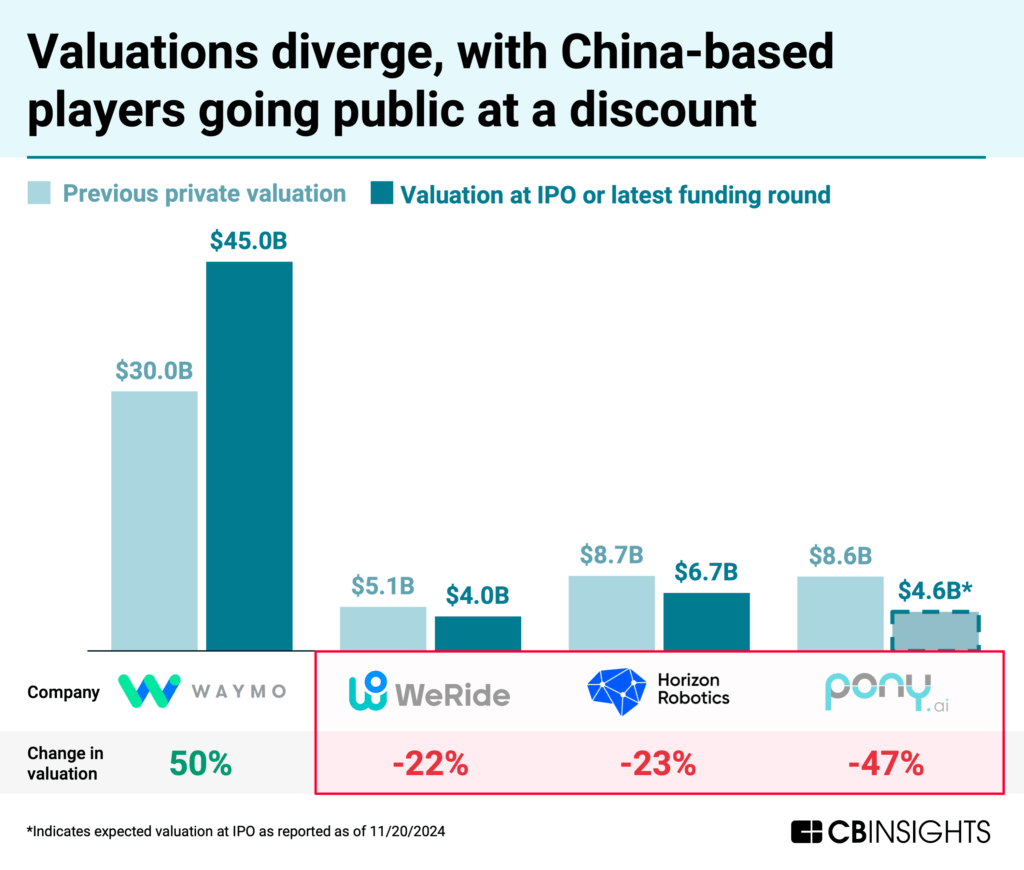

13. Chinese robotaxi companies went public at a discount

Waymo’s valuation jumped 50% between funding rounds. WeRide and Pony.ai both went public in fall 2024, at 22% and 47% discounts to their last private rounds. CB Insights notes that private funding for Chinese AV companies fell from $4B in 2021 to under $400M in 2024. Public markets were the only option left.

Since then the two have split. Pony.ai now trades 50% above its IPO price. WeRide is down 20%. The difference comes down to execution: Pony.ai hit unit economics breakeven in Guangzhou in November 2025, the first Chinese robotaxi company to do so. WeRide’s revenue actually declined 10% in 2024. Toyota formed a manufacturing JV with Pony.ai that’s producing Gen-7 robotaxis at 70% lower cost. WeRide has pushed into Europe and the Middle East, but geographic expansion hasn’t translated to the operational milestones investors want to see.

Honorable Mention: Interactive AV infographics out in the world

The graphics above are static. They captured the industry at a moment and that's where they will stay. The projects in this section try to stay current, and they rely on people contributing what they see.

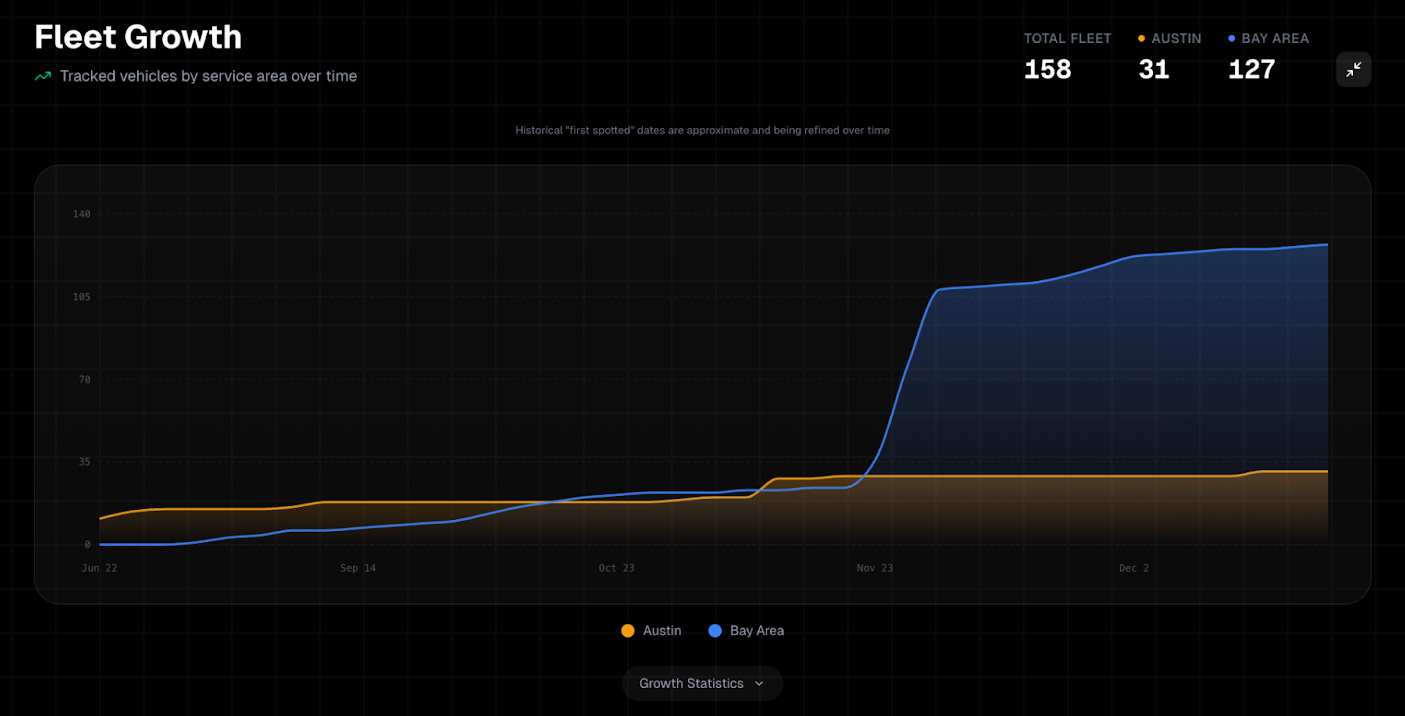

14. Tesla Robotaxi Tracker - Crowdsourced robotaxi fleet tracking

This project, built by Ethan McKanna, takes a clever approach to fleet tracking. Tesla doesn’t publish fleet numbers, so the community started documenting license plate numbers. Texas issues sequential plates, so counting unique sightings gives you a fleet estimate. As of mid-December, the tracker shows 158 Tesla vehicles: 31 in Austin, 127 in the Bay Area. Despite the name, it tracks Waymo too. If you spot a robotaxi in either market, submit a sighting through their site.

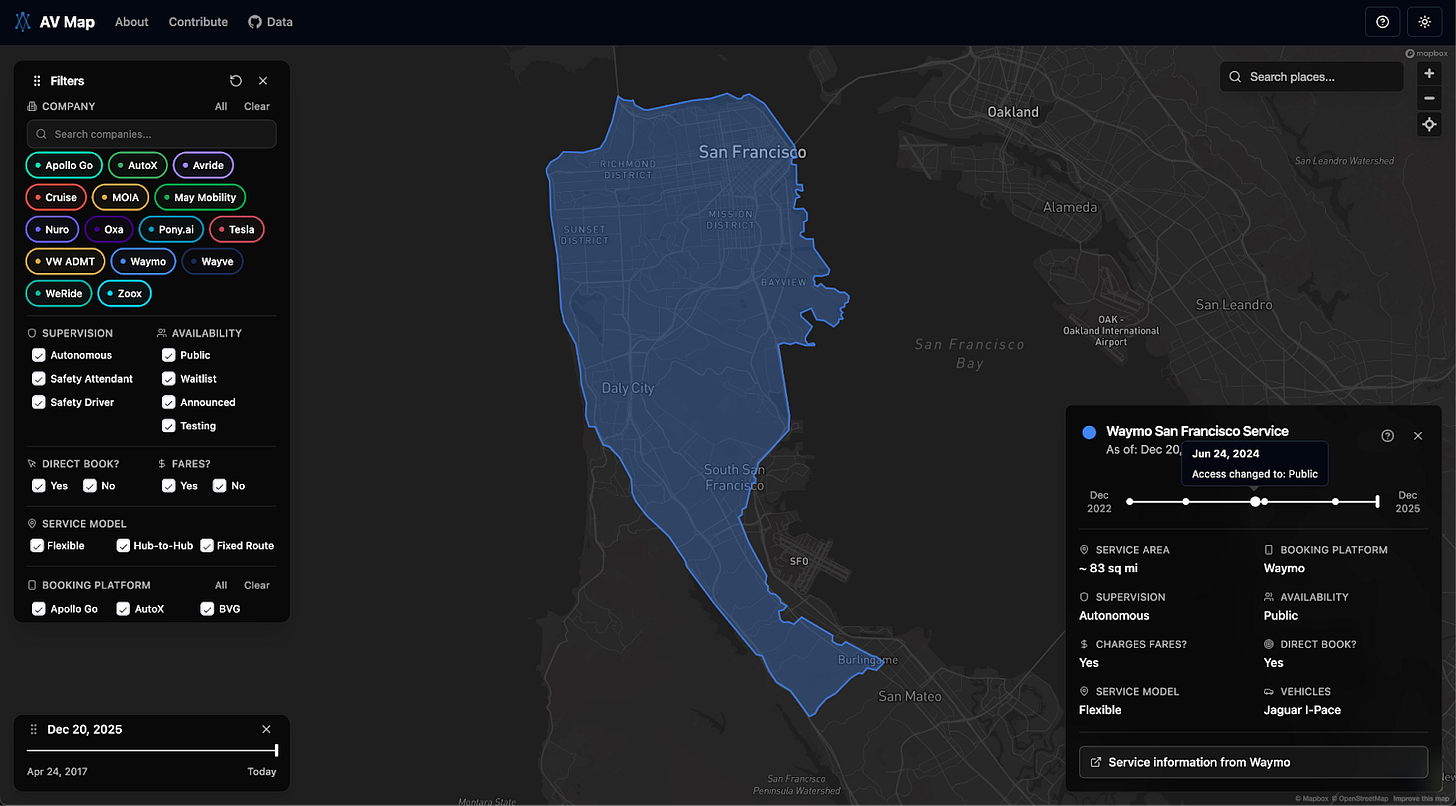

15. AV Map - Tracking the global growth of the autonomous ridehailing

AV Map is my project. I started building it after Waymo, Zoox, May Mobility, and Tesla all launched or expanded their AV services in summer 2025, and I couldn't find a single source showing current service boundaries and timelines. The site tracks where you can ride a robotaxi today, which cities have services testing or announced, and how coverage has changed since Waymo's 2017 Phoenix launch. All the data is open source on GitHub. Use it for research, journalism, your own projects, whatever you want. I recently added a contribution form at avmap.io/contribute so you don't have to open a pull request on GitHub or email me a CSV anymore. Submit new launches, service area changes, testing reports, just include a source.

This industry moves fast. If you want to be part of tracking it, both projects could use your help.

Service notes: Avride, May Mobility, and Tesla operate with safety drivers. For Avride, May Mobility, Waymo (Austin and Atlanta), and potentially Nuro, Apollo Go, and Wayve, autonomous rides are not bookable through an autonomous-only service. Tesla and Zoox (SF Bay Area) service is only open to riders accepted off of a waitlist. Zoox (Las Vegas) serves fixed hubs only and isn’t charging fares in either of its deployments.

Announced for 2026 but not yet live: Nuro (SF Bay Area), May Mobility (Dallas), Tesla (Dallas, Las Vegas, Phoenix, Houston, and Miami), VW (Los Angeles), Waymo (Dallas, Las Vegas, Houston, Miami, and London), Apollo Go (Abu Dhabi and Dubai), and Wayve (London).

This is a superb post with lots of info and analysis: bravo! And thanks. I will quibble a bit with the industry's assumption that once the cost/mile lines cross massive adoption will take off. (We said the same thing about TCO for EV versus ICE, remember?) I like robotaxis, I use them whenever I can, and I think their usage will soar. But I am not sure that the rosiest adoption scenarios will come to pass, because POINT TO POINT COST IS NOT THE ONLY THING THAT MATTERS TO CUSTOMERS. (If it were, no one would ever buy a new car in fact: a clean used Accord would beat any new car in cost/mile!) There are so many other sources of value in using your own car versus a rental/taxi/human-Uber/robotaxi: More CONVENIENT to jump in your own conveyance and go where you want when you want. We value our time and our capriciousness. Who wants to always be poking a phone to see where the darn cab is? COMFORT: You can set up your car to cater to your tastes, interests, needs and comfort. STUFF. Many of us treat our car as a backpack, full of stuff available to meet occasional needs: golf clubs, change of clothes for the gym, car seat for the kid. INDIVIDUALIZATION: Having your car as a statement of what kind of person you are can be a significant share of its value. Why does anyone ever buy a sports car? Arriving in an Uber says nothing. CONTROL: You can fix your costs of transportation with your own vehicle. Once I give up my own car, I am at the mercy of whatever prices the ridehail or robotaxi company sets. I can defer maintenance if I want, take the car to Cousin Fred for cheap work the OEM would never approve of. HEALTH: I can keep my car clean – or not, as I want, but I know who’s been in it: me. Do I want every trip I take to be with germs other riders have left behind? Remember Covid? RANGE: Ridehail and robotaxi economics depend on population density, reducing service and increasing price for rural trips. I want to be able to go anywhere at any time, with low marginal cost. ..... To me what this all says (plus falling robotaxi costs) is: PERSONALLY-OWNED AV. The AV tech is so great, and is getting cheaper, why not own the darn thing, versus have to summon-and-pay over and over? Put the kids' car seats in the back and leave 'em there. Leave the groceries in the trunk while you grab a ramen bowl: no need to summon a robotaxi twice. Etc. The future I see is: "Cadillac... plus Waymo Inside©" (grin) If cost/mile rules, why does ANYONE in Manhattan own a car? Because 25% of households there DO. My view: we find a new equilibrium: long trips (airplane), micro-trips (bike and feet (Shoeber)), medium unstructured trips (rental car), simple point-to-point trips (human or robo-ridehail), complex errand trips (owned car, AV or not AV). Etc. Silicon Valley always looks myopically at EFFICIENCY (doing things right) and not at EFFECTIVENESS (doing the right things). End of Rant!

Tesla is NOT doing AV in the SF Bay Area yet, nor even in Austin. Makes me seriously doubt any of the data in this post.